Applying for a Chase credit card can be a straightforward process when you understand the steps involved.

Whether you're seeking rewards, travel perks, or a straightforward cashback option, Chase offers a range of cards tailored to meet your needs.

This guide will walk you through the entire application process, from choosing the right card to what to do if you're approved.

Why Chase? Exploring the Benefits of Chase Credit Cards

Chase offers a variety of credit cards with unique benefits. Here’s why they stand out:

- Generous Rewards: Earn cash back, points, or miles on everyday purchases, with bonus categories including travel and dining.

- Sign-up Bonuses: Enjoy attractive welcome offers after meeting spending requirements.

- Chase Ultimate Rewards®: Redeem points for travel, gift cards, or transfer to travel partners.

- Travel Perks: Enjoy access to trip cancellation insurance, car rental coverage, and exclusive travel offers.

- Purchase Protection: Benefit from extended warranties, fraud monitoring, and purchase protection.

- No Foreign Transaction Fees: Ideal for international travel with no extra charges.

- Customer Service: 24/7 support for assistance anytime, anywhere.

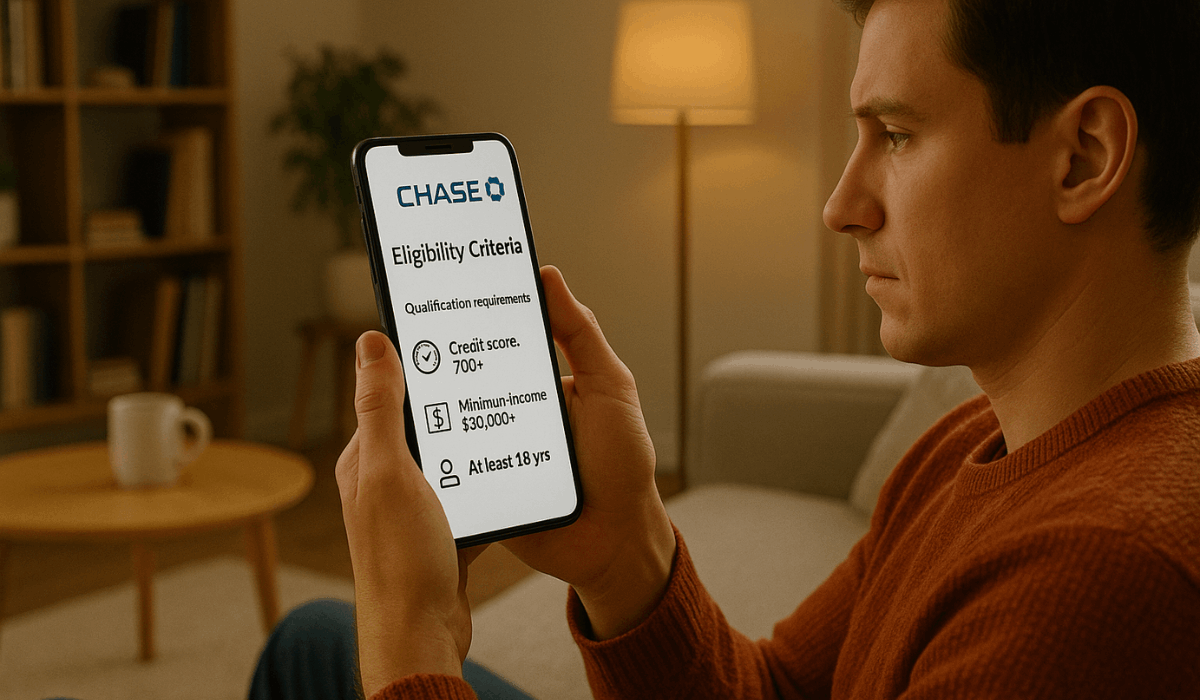

What You Need to Qualify

Before applying, it’s essential to know the basic requirements for approval.

Chase considers several factors to determine whether you're eligible for a card. Here’s what you need:

- Age Requirement: You must be at least 18 years old.

- Credit Score: Chase typically requires a good to excellent credit score (usually 700 or higher).

- Income: A stable income is essential, as it helps determine your credit limit.

- Debt-to-income Ratio: Your debt-to-income ratio plays a significant role in the approval process.

- U.S. Residency: Most cards require you to be a U.S. resident or have a valid U.S. address.

- Employment Status: Chase may request your employment details to assess your financial stability.

Getting Ready to Apply: Preparation Is Key

Before you submit your application, proper preparation is essential.

Ensuring you have everything in place will help streamline the process and increase your chances of approval. Here’s how to get ready:

- Check Your Credit Score: Knowing your credit score beforehand will help you assess your chances of approval.

- Gather Necessary Documents: Have your Social Security number, proof of income, and recent bank statements ready.

- Review Your Financial Situation: Take stock of your current debt and income to understand your creditworthiness.

- Choose the Right Card: Research Chase’s offerings to select the card that best fits your spending habits and financial goals.

- Understand Card Terms: Familiarize yourself with the card’s APR, fees, and rewards structure to ensure it’s the right fit for you.

The Chase Credit Card Application Process

Applying for a Chase credit card is a straightforward process; however, it’s essential to follow the steps carefully to ensure a successful application.

Here’s what you need to know about applying:

- Visit the Chase Website: Start by selecting the card you want on the Chase website.

- Fill Out the Application: Provide personal information such as your name, address, Social Security number, and employment details.

- Review Your Information: Double-check all details before submitting to ensure accuracy and avoid mistakes.

- Submit the Application: Once all requirements are complete, apply online.

- Confirmation and Review: You’ll receive confirmation of your application, and Chase will review your information.

- Approval or Denial: Chase will notify you of their decision, typically within a few business days.

- In-Branch Application Option: Alternatively, you can apply in person at a Chase branch.

What Happens After You Hit Submit: Approval Process Breakdown

Once you've submitted your application, the next step is to wait for approval.

Chase will review your details to determine your eligibility. Here’s what happens next:

- Credit Check: Chase performs a hard inquiry on your credit report to assess your credit score and history.

- Income Verification: They may verify your income to ensure you can handle the credit limit.

- Application Review: Chase evaluates your debt-to-income ratio, employment status, and financial stability to determine your eligibility for a loan.

- Decision: You’ll receive an approval, a denial, or a request for additional information.

- Approval Notification: If approved, Chase will send you a notification with the following steps to take.

- Denial Notification: If denied, you’ll receive a reason for the decision, along with advice on how to improve your credit for future applications.

Key Features and Rewards: Make the Most of Your Chase Card

Chase credit cards offer a range of features and rewards that can help you maximize your spending.

Here’s a breakdown of what you can expect:

- Cashback, Points, and Miles: Earn rewards on every purchase, with bonus categories like dining, travel, and groceries.

- Sign-up Bonuses: Get generous bonuses by meeting spending requirements in the first few months.

- Chase Ultimate Rewards®: Redeem points for travel, gift cards, or transfers to partner airlines and hotels.

- Purchase Protection: Enjoy extended warranties, fraud protection, and purchase security.

- Travel Benefits: Enjoy access to trip cancellation insurance, travel assistance, and lounge access with premium cards.

- No Foreign Transaction Fees: Many Chase cards waive fees for international transactions.

- Customer Support: Get 24/7 assistance with any card or account issues.

Interest Rates and Fees

Understanding interest rates and fees is key to managing your Chase credit card. Here’s a breakdown:

Interest Rates (APR):

- Purchase APR: Typically 18.99% to 28.74%, based on creditworthiness.

- Cash Advance APR: Typically 29.24%, which is higher than the purchase APR.

- Penalty APR: This may be applied if payments are missed or returned, remaining in effect until the account is paid in full.

Fees:

- Annual Fee: Some cards have no fee, while others, such as the Chase Sapphire Preferred®, charge $95.

- Foreign Transaction Fee: Typically 3%, but waived on select cards, such as Chase Sapphire.

- Late Payment Fee: Up to $40, depending on your card.

- Returned Payment Fee: Up to $40 if a payment is returned due to insufficient funds.

- Balance Transfer Fee: Usually 3% of the transferred amount.

- Cash Advance Fee: Typically 3% to 5%, plus interest charges.

Managing Interest Charges:

- Pay in Full: Pay off your balance monthly to avoid interest.

- Grace Periods: Most cards give at least 21 days to pay without interest.

- Avoid Balances: Carrying a balance results in interest charges.

- Set Up Auto-Pay: Automate payments to ensure timely payments and avoid late fees.

- Monitor Your Spending: Keep track of your purchases to stay within your budget and avoid overspending.

Contact Information

If you need assistance with your Chase credit card, here are the primary contact options:

Customer Service Numbers

- General Credit Card Support: 1-800-432-3117

- Business Credit Card Support: 1-888-269-8690

Online Support

- Secure Messaging: Log in to your Chase account and navigate to the Secure Message Center for assistance.

In-Person Assistance

- Branch Locations: With over 4,700 branches nationwide, you can find a Chase branch near you by visiting the Chase Branch Locator.

Mobile App

- Chase Mobile App: Available for download on iOS and Android devices for on-the-go account management.

The Bottomline

Applying for a Chase credit card can unlock valuable rewards, benefits, and financial flexibility.

By understanding the application process and key features, you can make an informed decision that fits your needs.

Start your application today and take the first step toward earning rewards and enjoying premium perks.

Disclaimer

Approval for a Chase credit card is subject to credit approval, and terms may vary.

The information provided is for general guidance and may not reflect current rates or fees.