In South Africa’s digital banking market, Discovery’s mobile onboarding makes it simple to join Discovery Bank in minutes and unlock rewards on day one.

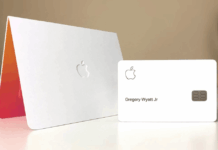

New clients register in the Discovery Bank app, complete secure biometric checks, and receive a virtual card that works immediately while a physical card is arranged.

Strong earn potential through Discovery Miles and status-linked rates adds practical value when payments, savings, and travel all live in one app. For clarity, the steps, requirements, card tiers, costs, and support details below keep the process tight and predictable.

What Joining Discovery Bank Means

In practical terms, joining means downloading the Discovery Bank app, verifying your identity, and activating a digital account that includes cards, savings, and everyday banking tools.

After activation, a virtual card appears in-app for instant use online and in stores through supported wallets. Physical card delivery follows a simple funding action that confirms account readiness and triggers issuance.

For rewards-focused spenders, integration across banking, insurance, and wellness can elevate earn rates when habits stay healthy and consistent.

How To Join On Mobile, Step-By-Step

Start in the Discovery Bank app, confirm security, then set up cards so payments work immediately. The sequence below mirrors the live flow and helps prevent bottlenecks during verification.

- Download The Discovery Bank App And Tap Join The Bank

In the app stores, install the Discovery Bank app, open it, and select Join the Bank to begin a new profile. - Confirm Details And Verify The Cellphone Number

After capturing personal information, enter the one-time code sent to the registered number so device trust is established. - Scan Your Face To Create A Facial ID

During onboarding, a short selfie scan binds the profile to a unique biometric, strengthening future approvals and device changes. - Activate, Add A Virtual Card, And Order A Physical Card

After activation, create a virtual card for immediate payments. For a physical card, deposit R250 or more, then request delivery inside the app.

Discovery Bank Credit Card Options and Eligibility

Joining gives access to Visa credit cards at multiple benefit levels, each designed around income bands, rewards, and digital controls.

Status in the wellness program influences rates and cashbacks, so good financial habits translate directly into lower borrowing costs and stronger earn.

Card Collections and Tiers

Within Discovery, credit cards sit in named “collections” that align costs and benefits with household income bands. Options scale from mainstream to premium so limits, fees, and perks stay proportional to affordability.

| Collection | Indicative Annual Income Band | Account Structure Notes |

| Gold | Below ~R350 000 | Entry pricing, full transactional features, rewards via Discovery Miles |

| Platinum | ~R350 000 to ~R850 000 | Wider benefits, higher limits, stronger earn potential |

| Black | ~R850 000 to ~R2.5 million | Premium travel perks, elevated service, richer discounts |

| Purple | Above ~R2.5 million | Top-tier benefits, concierge-grade features, highest limits |

Within every collection, clients pick either a standalone credit card account or a bundled suite that merges daily banking and credit into one monthly price.

Who Can Apply

Applicants must be at least 18, legally resident in South Africa, and able to provide a South African ID or passport with a valid permit. Standard credit and affordability checks apply, including bureau lookups and income verification.

Approval depends on document validity, score strength, debt levels, and overall affordability under local regulations.

Key Features That Matter Day To Day

In daily use, the value story centers on status-linked rates, flexible payments, and rewards that stretch spend further across flights, fuel, groceries, and digital purchases.

Dynamic Interest Rates

Under Discovery’s behavior model, interest responds to how responsibly the account is managed, linking outcomes to Vitality Money status.

Strong savings buffers, disciplined repayments, and low utilization can attract lower borrowing rates over time, while positive balances in eligible pockets earn competitive interest.

Discovery Miles and D-Day Discounts

Across card swipes and digital payments, Discovery Miles accrue on eligible purchases, then redeem at partners for meaningful savings.

During periodic Miles D-Day events, discounts can run as high as thirty percent, turning routine spend into outsized value when timing and categories align.

Contactless and Mobile Payments

On-device security plus tokenized credentials make in-store tap and in-app checkout smooth across Apple Pay, Samsung Pay, Garmin Pay, and Fitbit Pay.

Inside the app, instant virtual cards support merchant-specific numbers, adding a layer of control for subscriptions and travel bookings while keeping contactless payments fast and reliable.

Interest-Free Window and Controls

For qualifying purchases, the platform provides up to 55 days interest free, provided the full statement balance is paid by the due date.

Granular controls let clients set spending limits, enable geographic restrictions, and monitor real-time alerts so exceptions are handled quickly.

Fees, Interest, and The Fine Print

In Discovery’s pricing model, a single monthly amount typically covers the account and credit facility where suites are chosen, avoiding separate annual card fees.

Standalone credit card accounts follow a lighter fee structure, while premium collections include additional services that justify higher monthly pricing.

Monthly Fees and Facility Charges

Across collections, fee guides set a bundled monthly amount for suites that includes the rewards premium and facility components. Updates are normally published annually, so checking the latest schedule before applying keeps expectations accurate.

Interest Rates and Behavior Links

Borrowing rates float against prime and adjust based on internal risk assessment and Vitality Money status.

Clients who maintain low balances, pay on time, and keep utilization within reasonable bands can qualify for discounts from the base rate quoted in agreements.

Transaction Costs and Penalties

Local point-of-sale transactions are usually free, while ATM withdrawals incur fees that vary depending on domestic or international use.

Card replacement, courier services, foreign currency, and late or overlimit events carry separate fees, so reviewing the schedule inside the app avoids surprises.

How To Apply For A Discovery Bank Credit Card

After confirming eligibility and documents, the digital process moves quickly. A short, organized sequence prevents rework, reduces duplicate requests, and speeds up card activation.

- Review Product Details Against Personal Goals

In the app or product materials, compare fees, rates, rewards partners, and collections versus current income and spending habits. - Prepare Documents For A Clean Upload

Collect a valid South African ID or passport with permit, recent payslips or bank statements, and proof of address not older than a few months. - Start The Credit Application In-App

Registration captures personal details, contact information, and tax questions, followed by income, expenses, and consent for bureau checks. - Upload Documents And Pass Compliance Checks

KYC, anti-money-laundering, and affordability assessments follow. Clear scans and consistent data minimize back-and-forth during manual review. - Approve The Facility, Activate, And Set Controls

After approval, activate inside the app, set a PIN, create virtual cards, and add the card to wallets. For a physical card, fund the account with at least R250, then request delivery.

Discovery Bank Gold Credit Card: Why It Works For First-Time Upgraders

In the Gold collection, the Discovery Bank Gold Credit Card combines a flexible credit facility, everyday banking, and rewards without requiring separate providers for payments and savings.

Salary deposits, debit orders, EFTs, and pockets for goals sit beside virtual cards and travel tools in a single interface. For spenders who prioritize groceries, health categories, and fuel, partner cashbacks paid in Discovery Miles stretch budgets further when D-Day discounts are active.

Real-time alerts, category tracking, and merchant controls make it easier to keep balances in check and maintain eligibility for rate discounts.

Travel, Forex, and International Use

In-app travel integrates fares, hotels, and car hire, pairing card rewards with discounted inventory and automatic insurance when flights are purchased on an eligible card.

For cross-border payments, Real Time Forex Accounts in major currencies simplify spending abroad, while the Visa network supports international acceptance and zero-liability coverage for unauthorized transactions under program rules.

Because exchange rates and fees vary by channel, checking the live quote inside the app before confirming a purchase remains the best practice.

Support, Contacts, and Head Office

For general queries inside South Africa, the 0800 07 96 97 number routes callers to the help desk that operates continuously. International callers reach Discovery Bank through +27 11 324 5000 for account, card, and digital channel assistance.

Lost or stolen cards should be reported immediately on +27 11 324 4444 so blocking and reissue can proceed without delay.

Discovery Bank Limited’s head office sits at 1 Discovery Place, Sandton, 2196, a location used across official disclosures and correspondence addresses for regulatory purposes.

Compliance, Risk, and Smart Use

Approval depends on affordability, credit history, and valid documents, and outcomes can differ by applicant even inside the same income band.

Paying the full statement balance on time preserves the up to 55-day interest-free window on qualifying purchases and materially lowers costs throughout the year.

Keeping utilization moderate, building savings buffers, and avoiding cash advances protect both status and rate discounts under the behavior model. Because pricing and benefits can change, confirming the current fee guide and product terms inside the app prior to application remains essential.

Conclusion

In today’s card market, a streamlined mobile flow plus status-linked value gives clear reasons to join Discovery Bank and use a virtual card immediately, while a physical card is arranged.

For mainstream users, the Gold collection offers a strong blend of daily banking, rewards, and rate flexibility in one place.

For higher earners, Platinum, Black, and Purple expand perks, limits, and travel support while keeping controls inside the same secure interface. Careful payment habits, document readiness, and steady income make approvals smoother and long-term costs lower.