In South Africa’s mid-tier segment, applications for the FNB Premier Credit Card typically come from earners between R300 000 and R749 999 per year, which aligns with the FNB Premier income requirement.

As of today, pricing reflects FNB’s current annual guides, and rewards align with the latest eBucks rules for Premier.

What The FNB Premier Credit Card Is

FNB Premier operates as a Visa credit facility aimed at professionals who want strong digital tools, useful travel benefits, and eBucks earn across major retail partners.

Card management happens inside the FNB App, where limits, virtual cards, spending categories, and repayment schedules can be adjusted in real time.

Everyday use remains simple, since the card supports contactless payments, online purchases, and wallet provisioning across Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and SwatchPAY.

Rewards center on FNB eBucks rewards, lounge entries through the SLOW network on qualifying levels, and periodic retailer offers on the budget facility.

Who Qualifies and What To Prepare

A short preparation window eliminates most delays, especially for first-time FNB applicants.

Meeting income and document requirements matters more than any single preference, because underwriting checks credit behavior, affordability, and verified identity.

Clean documentation shortens turnaround times, and accurate declarations reduce back-and-forth on affordability. Applicants who gather statements and payslips upfront generally see faster outcomes.

Income and Residency

Applicants should earn a gross annual income between R300 000 and R749 999 and be at least 18.

South African residency, a valid SA ID, or a passport plus work visa where applicable is required. Affordability checks consider existing debt obligations and verified income stability.

Documents Checklist

Keep a recent payslip, three months of bank statements, and proof of residence not older than three months.

Digital scans must be legible, complete, and free of edits or annotations. Matching names and addresses across documents removes a common cause of manual review.

Credit Health Tips

Settling small arrears, lowering utilization on other cards, and avoiding new debt inquiries in the weeks ahead materially improves approval odds. Credit files with consistent on-time payment histories typically unlock stronger limits and better initial rate outcomes.

FNB Premier Credit Card Benefits

Premier consolidates several lifestyle and protection features that matter in daily use. Benefits scale with reward level, which depends on account behavior, partner engagement, and app activity.

Frequent travelers gain value through lounge entries and travel insurance, while household budgets benefit through targeted eBucks earn at national chains. Risk control improves through the virtual card and immediate purchase cover.

eBucks and Partner Deals

Earn and spend eBucks at Takealot, Pick n Pay, Clicks, and Engen, then track everything inside the app for quick redemptions.

Partner campaigns appear regularly on the FNB budget facility, including iStore, KOODOO, The Pro Shop, and Cycle Lab, generally at interest rates starting near prime or prime plus two, subject to your profile.

Tech and appliance purchases through the eBucks Partner Shop can qualify for up to 40 percent back in eBucks on the monthly premium when financed on budget after opt-in.

Travel and Lounge Access

SLOW Lounge access forms part of the Premier reward structure, with up to eight complimentary domestic visits per year on qualifying levels.

Flight discounts booked via eBucks Travel can reach up to 40 percent on selected routes, and qualified customers pairing FNB Short-Term Insurance can unlock deeper domestic flight savings that scale to higher tiers.

Global Travel Insurance applies when flights are paid on the card, simplifying medical cover requirements for trips.

Virtual Card and Purchase Protect

The FNB Virtual Card adds a rotating CVV, one-tap blocking, and simple card creation for subscriptions or once-off online purchases.

FNB Purchase Protect provides instant insurance for eligible items bought using the virtual card, up to product limits, which reduces risk during high-value transactions.

Wallet compatibility across major platforms lets the virtual card work at contactless terminals worldwide.

Medical and Device Financing

Medical transactions can post at rates linked to prime, and up to 55 days interest-free on qualifying purchases supports short-term cash flow when statements are cleared in full.

Device purchases through featured partners can return up to 40 percent back in eBucks on the financed premium when the FNB budget facility is used after opting in. These structures help manage larger expenses without losing rewards momentum.

Fees, Rates, and Limits

Pricing differs slightly between the standalone credit card and the broader Fusion bundle.

Monthly fees also separate the card account from the revolving credit facility service fee. Updated figures appear in FNB’s published pricing guides each year, and the values below reflect December 2025 publications for Premier.

Monthly Fees

FNB Premier monthly fee appears on comparison pages as “from R115 p.m.”, which aligns to two components: a card account fee near R90 p.m. plus a credit facility service fee around R25 p.m.

One additional card carries no monthly charge, while subsequent additional cards attract a small fee per card. A once-off initiation fee up to R199 applies on activation.

Interest and Budget Facility

The FNB budget facility amortizes larger purchases over a set term at personalized rates often referenced to prime, for example prime or prime plus two depending on your risk tier.

Statements disclose the exact annual rate, repayment period, and remaining principal, which promotes transparent planning. Early settlements on budget items can be made inside the app to reduce interest without friction.

Interest-Free Period

Up to 55 days interest-free on qualifying purchases is available when the full statement balance is paid on time, excluding cash advances and certain transactions.

Paying the total due by the statement due date preserves the grace period for the following cycle. Missed or partial payments typically cancel the grace benefit until the account returns to good standing.

Limits and Repayments

Credit limits are personalized during onboarding and can be reviewed after consistent on-time use.

Repayment controls inside the FNB App allow limit adjustments, scheduled payments, and immediate transfers when budgets tighten. Alerts for authorizations, settlements, and due dates provide timely prompts that help maintain payment discipline.

Step-By-Step: FNB Premier Credit Card Application

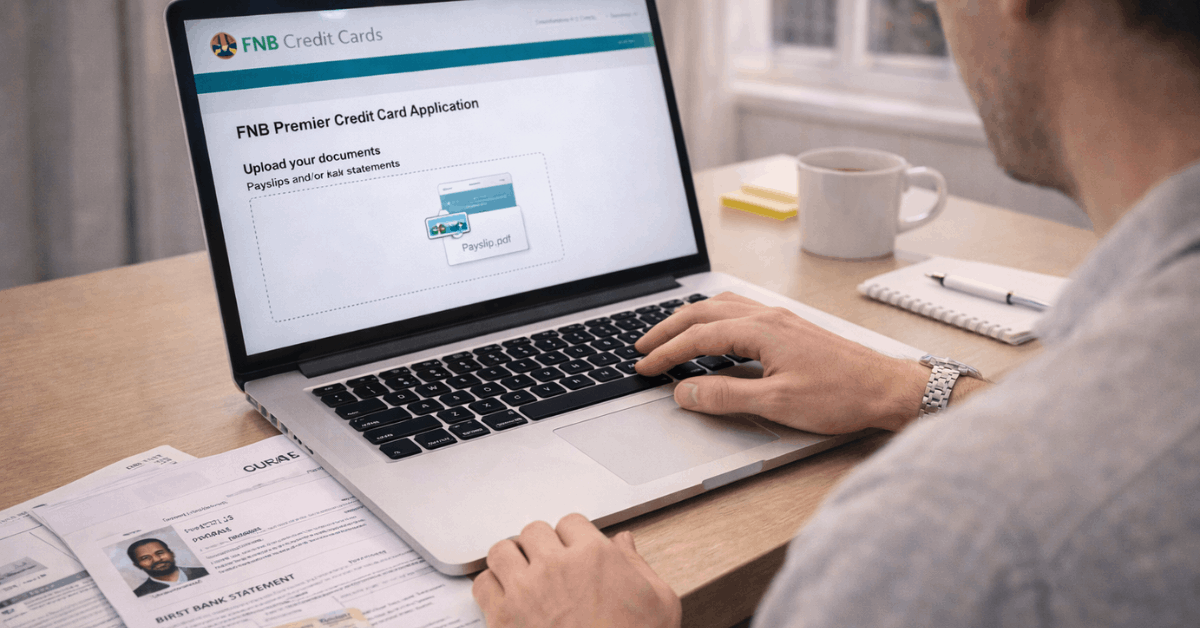

A short, structured sequence moves the process along without messy follow-ups. Existing FNB clients generally finish faster because profiles and KYC documents already sit on file. New-to-bank customers can still apply fully online using secure document uploads.

- Open the FNB App or visit the FNB Credit Cards page, then choose Premier under Products.

- Log in to Online Banking or create a profile, then confirm personal details, employment, and income.

- Select Credit Card, choose Premier, and complete affordability questions accurately to avoid manual queries.

- Upload a recent payslip, three months of bank statements, and a current proof of residence that matches your profile.

- Review disclosures, consent to credit checks, and submit the application for a real-time decision where possible.

- Respond to any verification requests promptly, since quick replies keep the application in the fast lane.

- After approval, activate the card on delivery and create an FNB Virtual Card for immediate online or wallet payments.

Instant Approval: What It Really Means

“Instant” decisions remain conditional on verified documents and a credit bureau check.

Automated approvals do occur for clean, well-documented profiles, although additional verification can still pause finalization.

Card delivery usually completes in roughly seven to fourteen business days, and a virtual card may become available sooner for online purchases once the facility is active. Secure Chat inside the FNB App and the Premier Suite on 087 577 7000 provides escalations when files need manual assistance.

Fusion Premier Vs Premier Credit Card

Bundling through Fusion Premier places the credit facility inside a transactional account for a single monthly fee.

Standalone Premier keeps the credit card separate, which suits customers who prefer existing current accounts or multi-bank setups. Rewards coverage remains comparable, while pricing and convenience determine the best fit.

Comparison Snapshot

| Feature | FNB Premier Credit Card | FNB Fusion Premier |

| Monthly Pricing | From R115 p.m. across account and facility | R250 p.m. single account fee |

| Account Structure | Standalone credit card facility | Combined transactional and credit facility |

| Rewards & Lounges | eBucks earn, SLOW Lounge access on qualifying levels | eBucks earn, SLOW Lounge access on qualifying levels |

| Virtual Card & Wallets | FNB Virtual Card supported across major wallets | FNB Virtual Card supported across major wallets |

| Who It Suits | Customers keeping current account elsewhere | Customers wanting one fee and one account |

Support, Activation, and Security

Activation happens quickly through the app after delivery, and PIN management can be completed at ATMs or inside secure channels. Purchase categories, limits, and travel notifications should be configured immediately, since accurate settings lower fraud risk and prevent declines.

Customer support spans Secure Chat in the app and the Premier Suite line at 087 577 7000, while general card servicing uses dedicated credit card teams reachable during extended hours.

Lost or stolen cards can be blocked instantly inside the app, followed by a replacement request and virtual card setup for uninterrupted online payments.

Conclusion

For Premier applicants ready to proceed, the path is straightforward and predictable. Meet the income band, prepare clean documents, and complete affordability steps accurately to accelerate approval.

Daily value then comes through eBucks earn, SLOW lounge visits, virtual card security, and purchase protection.

Keep repayments on schedule to preserve up to 55 days interest-free and control budget facility costs. If a bundled account suits your habits, compare Fusion Premier against standalone pricing and proceed confidently.