A credit card from Investec sits inside private banking rather than operating as a standalone product.

Investec focuses on professionals and entrepreneurs, so requirements skew higher than mass-market banks, and benefits concentrate around travel, payments, and integrated digital tools.

For clarity, approval happens through an Investec Private Bank Account rather than an independent card line. That structure simplifies fees into one monthly price while attaching the Visa Platinum facility, rewards, travel access, and programmable features that suit higher-income households.

What Counts As The Investec Credit Card

Investec issues a Visa Platinum credit facility that lives inside the Investec Private Bank Account. The facility offers up to 45 days of interest-free credit on qualifying purchases when the full statement balance is paid by the due date.

ATM cash withdrawals on the account are unlimited at Investec’s side locally and internationally, although foreign ATMs or networks may add their own charges and currency conversion costs.

Because the card comes with the account, the application steps center on opening a private banking account first. That is the point at which identity, income, and professional status are assessed, and where pricing and benefits for the card are set.

Card Options and Core Benefits

A quick overview helps you select the correct track before applying. Requirements and features differ for personal banking and business usage. The choices below separate personal private banking from corporate and practice needs.

Pick the path that matches everyday spending and accounting responsibilities. Incorrect selection creates avoidable admin later, especially if business expenses mix with personal purchases.

Investec Private Bank Account + Visa Platinum

Private banking targets professionals and high-earning individuals who want consolidated fees and premium perks.

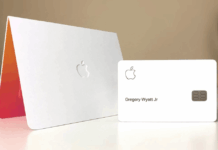

The Visa facility is priced relative to South Africa’s prime lending rate and supports Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and Fitbit Pay wallets. Travel benefits include Investec airport lounge access through DragonPass-linked lounges and South African lounge partners.

Daily use is supported by unlimited free ATM withdrawals charged at Investec’s side and interest on positive balances left in the account. Purchase protection and extended warranties appear on selected transactions under the programme rules.

Corporate and Business Credit Cards

Business and practice owners can issue cards to manage company expenses.

Visa Business cards are commonly priced off prime, include up to 45 days interest-free on card purchases, and may trigger complimentary travel insurance when eligible international tickets are bought using the card.

Integration aligns with Investec’s business platforms, including programmable tools that surface real-time card transaction data for spend limits, notifications, and controls.

Eligibility and Documents

Meeting Investec’s entry criteria matters more than fine-tuning card preferences. Requirements shift based on age, residency, and professional status, so confirm the band that applies to your situation.

As a rule, Investec credit cards are offered to clients who either hold or qualify for private or business banking. South African residents typically use a green barcoded ID or Smart ID; foreign applicants generally need a passport plus a valid work or residence permit.

Credit history must be clean, debt-to-income manageable, and employment verifiable through recent payslips and bank statements.

Who Qualifies In South Africa

Income thresholds vary by age and segment. Private banking for individuals 30 and older usually starts at R800,000 annual income.

Investec young professionals under 30 may qualify for R600,000 a year, and some regulated qualifications attract reduced earnings criteria. Separate business banking assessments apply to practices and companies.

Income and Fee Snapshot

The figures below help benchmark expectations. Fee levels and thresholds reflect Investec’s current disclosures and can be adjusted periodically, so confirm the latest schedule when you apply.

| Profile | Typical Income Threshold | Indicative Monthly Fee | Notes |

| Young Professionals (<30) | R600,000 per year or recognised qualification | R340 | Discounted fee; full private banking benefits; LifeStarter available. |

| Professionals (30+) | R800,000 per year or more | R675 | Standard private banking pricing; Visa Platinum facility included. |

| Foreign Nationals | Case-by-case; proof of permit and income | As per segment | Passport plus valid SA permit; enhanced KYC applies. |

| Business/Practice Owners | Business underwriting applies | Business fees vary | Corporate Visa cards; travel insurance on eligible ticket purchases. |

Documents To Prepare

Intro for the list: Submitting complete, legible documents speeds verification and prevents back-and-forth. Align the data on payslips, bank statements, and the application form to avoid mismatches.

- SA ID document or passport, plus a valid work or residence permit for non-citizens.

- Proof of residential address not older than three months, such as a utility bill or lease.

- Recent payslips and at least three months of bank statements showing salary deposits.

- Evidence of professional status, where applicable, such as board registration or a qualification letter.

What To Confirm On Fees and Interest

Investec prices private banking using a bundled fee rather than a separate card-only charge. The credit facility is individually priced, and interest rates are personalised off prime. As of today, the South African prime lending rate sits at 10.25 percent per year under South African Reserve Bank disclosures.

Private Bank Account fees currently show R675 a month for standard clients and R340 a month for clients under 30 on the young-professional tier, effective in the latest published schedule.

Unlimited ATM withdrawals at Investec’s side are part of the bundle, while foreign acquirers can add their own fees.

Bundled Monthly Fee

One fee covers the main current account, the Visa Platinum facility, digital banking, and core day-to-day services.

Additional services such as international currency conversion, foreign ATM operator charges, or third-party lounge add-ons remain outside Investec’s control and can appear separately.

Interest Rate Basics

Investec does not publish a single fixed APR for all clients. Pricing is personalised in the credit agreement and references the prevailing prime rate plus or minus a margin tied to risk.

Rate changes track future SARB decisions; statements and notices reflect adjustments after each monetary policy move.

Interest-Free Period and Budget Facility

The Investec interest-free period can run up to 45 days on qualifying card purchases when the full statement balance is paid on time.

A budget facility is available for larger expenses and can extend repayment terms up to 60 months, subject to individual approval and cost disclosures.

How To Apply Online

A focused preparation window reduces friction. Strong applications line up residency, income, and professional status, then follow a clean digital path on Investec Online.

- Start on the official Investec South Africa site and locate the “Get Started” or account application flow for the Investec Private Bank Account.

- Complete personal, contact, and residency details, then capture employment, income, and expense information carefully.

- Upload supporting documents: SA ID or passport, valid permit where applicable, recent proof of address, payslips, and three months of bank statements.

- Consent to a credit check and confirm declarations regarding accuracy, affordability, and risk disclosures.

- Submit the application and monitor the status; respond promptly to any request for additional documents or clarifications.

- On approval, complete account opening steps; the Investec Visa Platinum facility and card issuance follow as part of the account.

- Activate the card, enrol for the Investec app, enable digital wallets if required, and set spend limits or programmable controls as needed.

Practical Tips Before Applying

Short checks ahead of time avoid declines and ensure the product fit matches real spending.

- Verify that income, age, and professional status align with current Investec credit card requirements for private banking.

- Pull a recent credit report and clear any arrears to improve affordability metrics.

- Decide how the straight facility and budget facility will be used across planned purchases.

- Request the current fee schedule and confirm how the personalised rate references prime at 10.25 percent as of December 2025.

- Capture exact employer names and salary credits on the form so bank statements match the data fields.

Extras For Investec Young Professionals

Young-professional clients under 30 qualify for a reduced R340 monthly fee and access to LifeStarter, which provides R25,000 in complimentary life insurance until age 30 under Investec Life terms.

Vehicle finance can price at up to prime minus 1 percent for new vehicles, and home-loan support includes options for up to 100 percent bond finance with transfer fees included and up to R5,000 toward miscellaneous attorney costs under Investec’s young-professional offering.

These benefits remain subject to credit approval and published programme rules.

Rewards, Travel, and Digital Controls

Investec Rewards features no membership fee and allows points that do not expire under the current rules. Redemption spans travel, retail, and points-to-cash options.

Airport access runs through Investec airport lounge access across local partners and the DragonPass network, and a dining-for-lounge-visit option may be available at participating locations.

Programmable banking tools can stream real-time card transaction data to external systems for budgeting, alerts, and spend controls.

Contact Details For Investec South Africa

Investec Bank Limited, 100 Grayston Drive, Sandown, Sandton, Johannesburg, 2196.

Main switchboard: +27 11 286 7000.

Global Client Support Centre operates 24/7 for account and card assistance; cardholders can request verification, report fraud, or query travel benefits through this channel.

Compliance Notes and Sensible Use

South African credit facilities fall under the National Credit Act, affordability rules, and Know-Your-Customer requirements under the Financial Intelligence Centre Act.

Expect identity verification, income validation, and a credit check during the digital process.

Statements disclose personalised rates, fees, and interest-free timing; paying the full statement balance protects interest-free eligibility and keeps the profile strong for limit reviews.

Conclusion

Success hinges on treating the Investec credit card as part of private banking. Pick the correct track, meet income bands, and submit clean documents for fast approval.

Expect prime-linked pricing, a bundled monthly fee, and up to 45 days interest-free. Digital wallets, rewards, lounge access, and programmable controls deliver daily utility that matches professional needs.

Confirm current fees and the 10.25 percent SARB prime rate, then activate and use responsibly.