The Migros Card offers a convenient way to earn rewards and discounts and enjoy exclusive shopping benefits.

Whether you're looking to save on your next purchase or earn loyalty points for future rewards, applying for the Migros Card is straightforward.

In this guide, we'll walk you through how to apply for the card and start using it instantly so you can take advantage of its benefits immediately.

What is the Migros Card?

It is a loyalty and payment card that offers users discounts, cashback, and rewards on purchases made at Migros and partner stores.

Types of Cards Available

The Migros Card offers different types of cards to cater to various needs. Here are the main options available:

- Migros Credit Card: A traditional credit card offering purchasing power with the ability to earn rewards and benefits.

- Migros Prepaid Card: A prepaid card that allows users to load funds in advance and spend within their budget.

- Migros Bonus Card: A loyalty card focused on earning points and discounts on purchases at Migros stores.

- Migros Digital Card: A virtual card for instant use in online transactions, offering the same benefits as the physical card.

How to Apply for the Migros Card

Applying for the Migros Card is straightforward and can be done digitally or in person. Here's how:

Online Application via Smartphone

- Prepare Your ID: Have a valid ID or passport ready.

- Download the Migros App: Install the Migros app on your smartphone.

- Start the Application: Open the app and navigate to the credit card section.

- Submit Your Details: Follow the prompts to enter your personal information.

- Identity Verification: Use your phone's camera to scan your ID for verification.

- Instant Use: Upon approval, you'll receive your card details immediately for digital use. The physical card will be mailed to you.

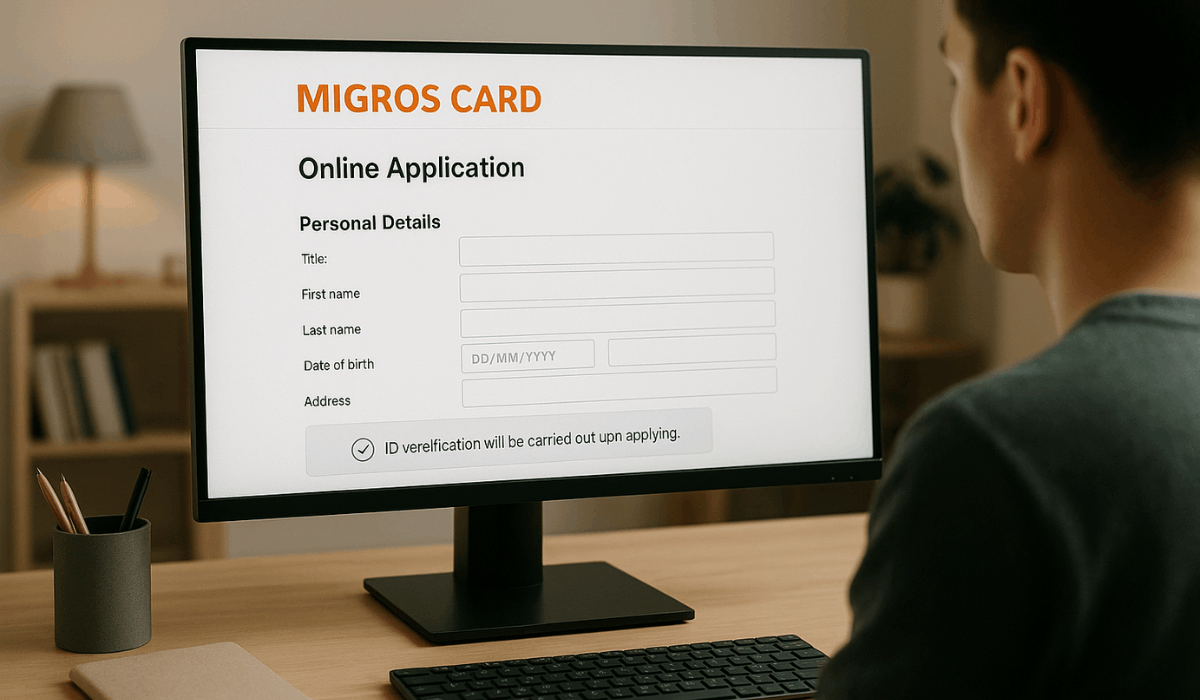

Online Application via Website

- Visit the Application Page: Go to the Migros Cumulus credit card application page.

- Fill Out the Form: Complete the online application form with your details.

- Submit Your ID: Upload a scanned copy or photo of your valid ID or passport.

- Mail Confirmation: After submission, you'll receive a confirmation letter by mail.

- Return Signed Form: Sign the confirmation and return it as instructed.

- Receive Your Card: Once your application is processed, your physical card will be sent to you.

In-Store Application

- Visit a Migros Store: Go to any Migros location.

- Request an Application: Ask for a Migros Card application form at the customer service desk.

- Complete the Form: Fill out the form with your personal information.

- Submit Your ID: Provide a copy of your valid ID or passport.

- Immediate Use: After processing, you'll receive your card for immediate use.

Eligibility Requirements

To apply for this card, ensure you meet the following criteria:

- Age: Applicants must be at least 18 years old.

- Residency: You need to be a resident of Switzerland.

- Identification: A valid Swiss ID, passport, or residence permit is required.

- Financial Standing: Migros Bank may assess your creditworthiness and financial situation during the application process.

- Sole Beneficial Ownership: The funds to settle the credit card bill must belong solely to the applicant.

Migros Card Features and Benefits

It offers a range of advantages designed to enhance your shopping experience and financial flexibility. Here's a breakdown of its key features:

No Annual Fee

- Enjoy a credit card with no annual fee, making it a cost-effective choice for everyday purchases.

Cashback Rewards

- 1% cashback on purchases at Migros stores.

- 0.33% cashback on purchases at other retailers.

- Earn Cumulus points instead of cash; 500 points equal CHF 5 in vouchers.

Free Additional Cards

- Obtain up to three cards for family members in the same household, all at no extra cost.

Mobile Payment Support

- You can make secure payments using mobile wallets like Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, Garmin Pay, and SwatchPAY!

Cash Withdrawals

- Free withdrawals up to CHF 1,000 per day at Migros checkouts.

- Two free withdrawals abroad per year, up to CHF 500 each.

- Subsequent withdrawals incur a 2.5% fee (minimum CHF 5).

Insurance Coverage

The card includes several insurance benefits:

- Purchase protection up to CHF 2,000

- Trip interruption insurance up to CHF 4,000

- Rescue and repatriation costs up to CHF 60,000

- Online account protection up to CHF 10,000

- Legal protection for online transactions up to CHF 10,000

Digital Management

Manage your card easily through the Viseca One app, where you can:

- Track spending

- Set spending limits

- Block or unblock your card

- Access eBill and direct debit options

Personalized Card Design

- Customize your card with a personal photo for free on the first order; subsequent changes cost CHF 20.

Optional Balance PROTECT Insurance

For an additional 0.5% monthly premium, this insurance covers your outstanding balance in case of:

- Involuntary unemployment.

- Incapacity to work due to illness or accident.

- Death due to illness or accident.

Migros Card Fees

The Migros Cumulus Visa credit card is designed to be a cost-effective option. It offers numerous benefits without incurring high fees.

Here's a breakdown of its key costs:

Annual Fees

- Primary Card: Free

- Additional Cards: Up to 3 free cards for household members

Cash Withdrawals

- At Migros Stores: Free up to CHF 1,000 per day

- Within Switzerland: 2.5% fee per withdrawal, with a minimum of CHF 5

- Abroad: Two free withdrawals per year, up to CHF 500 each; thereafter, a 2.5% fee per withdrawal, with a minimum of CHF 10

Foreign Currency Transactions

- Purchases in Foreign Currency: No administrative fee

- Currency Conversion Markup: Approximately 2.99% above the interbank exchange rate

Paper Statements

- Monthly Paper Invoice: CHF 2

- Additional Copies: CHF 5 each

- Card Replacement and PIN Services

- Replacement Card: CHF 20

- PIN Replacement: CHF 10

Balance PROTECT Insurance

- Premium: 0.5% of the monthly invoice amount

- Coverage: Up to CHF 15,000 per incident, with a total maximum of CHF 45,000 per card agreement

Migros Card Customer Support

If you need assistance with your card, several support options are available to help you.

24/7 Emergency Hotline

- For urgent issues like a lost or blocked card, you can contact the emergency hotline at +41 58 234 5050. This service is available 24/7.

Cumulus Infoline

For general inquiries about your Cumulus account or credit card, reach out to the Cumulus Infoline:

- From Switzerland: 0848 85 0848 (8 rappen per minute from Swiss fixed-line networks)

- From abroad: +41 44 444 88 44 (costs depend on your provider)

Operating hours are:

- Monday to Friday: 08:00 – 19:00

- Saturday: 08:00 – 16:00

Online Support and Forms

For specific issues like address changes, insurance claims, or disputes, you can use the online contact forms provided by Migros Bank:

- Support Page: Migros Bank Support

The Bottomline

In conclusion, the Migros Card offers excellent benefits, from cashback rewards to insurance coverage, making it a valuable choice for everyday purchases.

With a simple application process and instant usage options, you can enjoy the perks immediately.

Apply for your Migros Card today and unlock exclusive rewards while shopping at Migros and beyond!

Disclaimer

The information provided in this article is for informational purposes only and may be subject to change.

For the most up-to-date details on the Migros Card, please refer to the official Migros website or contact customer support.