Applying online should feel clear and predictable, not like a guessing game. In Sri Lanka, People’s Bank issues Visa and Mastercard products across several tiers, pairing everyday features with flexible repayment options and security that fits cross-border use.

In practical terms, eligibility sits at ages 18 to 65 for Sri Lankan citizens, with different document sets for salaried and self-employed applicants.

Expect your card to include NFC contactless, 3D Secure People’s Bank authentication for online purchases, SMS alerts per transaction, and an interest-free period up to 51 days when statements are paid on time.

What PEOPLE BANK Offers

People’s Bank positions its credit cards inside a broader public mandate: improve the quality of life, enable enterprise development, and contribute to national economic growth while operating sustainably.

Operations trace more than 64 years in service, a large nationwide footprint, and millions of active customers who use outlets, ATMs, and digital channels daily.

Strategically, the bank focuses on driving excellence, building customer centricity, and staying future-ready, which shows up in product updates, mobile integrations, and merchant security standards. Values emphasize:

- integrity,

- accountability,

- agility,

- continuous learning,

- team spirit,

- empowerment, and

- diversity.

Everyday cardholders experience these values through reliable service at branches, quick support via digital channels, and transparent communications about fees, repayments, and usage.

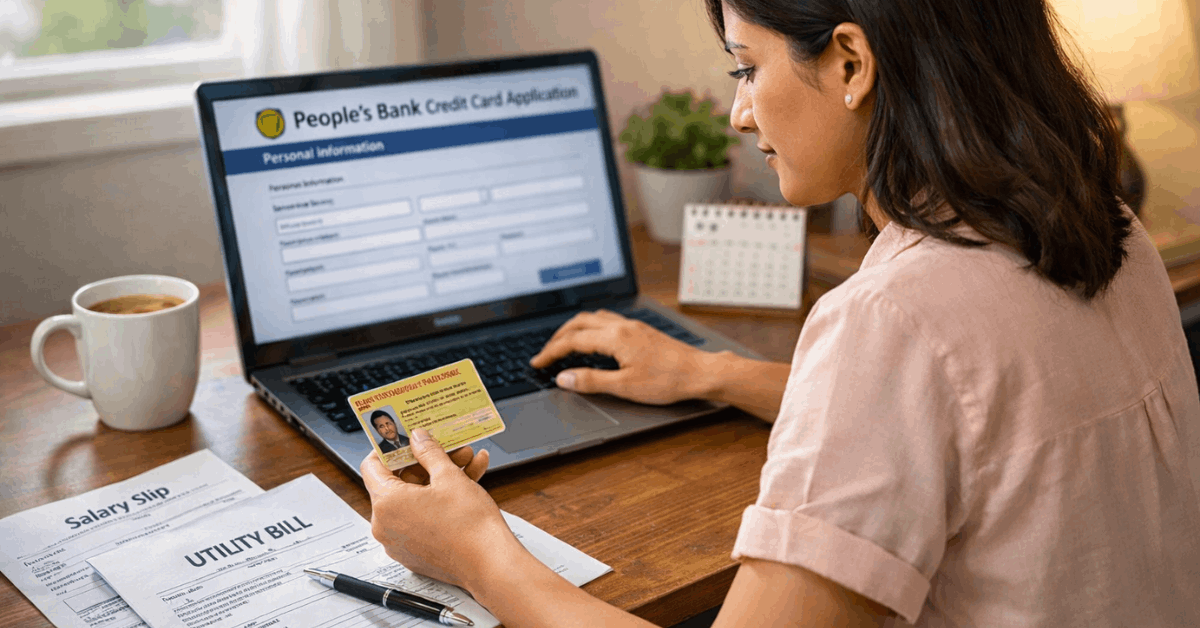

Eligibility and Required Documents

A short upfront checklist reduces back-and-forth and speeds the review clock. This section clarifies Sri Lanka credit card eligibility, lists the People’s Bank credit card requirements for each applicant type, and notes small but important details that often delay approvals.

Plan to scan or photograph clear copies and keep originals ready for branch verification if requested.

Who Can Apply

Sri Lankan citizens aged 18 to 65 form the core eligible group for primary cards. Supplementary cards can be issued to family members subject to internal rules and age thresholds, which card services can confirm during onboarding.

Documents For Salaried Applicants:

- Duly completed credit card application, ensuring all fields match identity documents.

- Copy of a valid NIC, driving license, or passport as accepted photo identification.

- Service ID card copy or a service confirmation letter issued by the employer.

- Certified salary slips for the most recent two months to verify income stability.

- Billing proof, such as a utility bill or bank statement, if requested during review.

Documents For Self-Employed Or Business:

- Duly completed credit card application reflecting accurate business and contact details.

- Copy of a valid NIC, driving license, or passport to establish identity.

- Copy of business registration matching the legal entity applying for credit.

- Income proof documents, unless an existing People’s Bank customer is already qualified.

- Billing proof on request, typically a recent bill to confirm the serviceable address.

Credit Card Types and Core Features

Picking the right tier helps align fees, limits, travel protections, and lifestyle perks.

The lineup covers entry cards for everyday spend, mid-tier options for higher limits and offers, and premium cards with elevated travel benefits.

All variants ride on the same merchant acceptance rails and are eligible for 3D Secure People’s Bank authentication on e-commerce payments.

Entry To Premium Tiers

People’s VISA Classic or MasterCard Classic address foundational needs, while VISA Gold or MasterCard Gold raise limits and add stronger partner offers.

Platinum variants layer richer privileges, and Signature or World tiers address frequent travelers seeking better overseas coverage.

People’s Elegance Visa Infinite targets premium users, and corporate or SME business credit cards support company expenses under centralized controls.

Shared Features That Matter

Across tiers, cardholders see Great Deals and Offers during the year, installment plans for sizable purchases, and a balance transfer People’s Bank facility to move higher-APR debt into a structured plan.

Expect free overseas travel insurance on eligible tiers, supplementary cards for family management, NFC Tap and Go for quick payments, and SMS notifications for every transaction to reduce surprises.

The interest-free period reaches up to 51 days on straight purchases when full statement balances are paid on time.

How To Apply Online and Activate

Setting up digital access immediately after approval prevents missed payments and late fees.

The steps below summarize how to apply to the online People’s Bank, finish KYC, and move quickly to safe usage through People's Bank online banking and the mobile app.

- Check Eligibility And Pick A Card Tier

Confirm age and residency, review limits that match income, and shortlist the most suitable variant. - Prepare Documents And Submit The Application

Complete the application accurately, attach identity copies, employment or business proofs, and recent salary slips if salaried. - Complete Verification And Await The Decision

Respond to any clarifications, provide billing proof if requested, and monitor SMS or email for approval updates. - Receive, Activate, And Enroll In Digital Banking

Activate the card per the instruction leaflet, then register for Internet Banking and the People’s Pay app to enable payments and controls. - Set Controls, Add To Wallet, And Test A Small Transaction

Configure alerts and daily limits, add the card to a mobile wallet if supported, and make a low-value purchase to validate 3D Secure People’s Bank authentication.

Fees, Interest, and Payment Options

Product disclosures specify pricing per tier, including finance charges on revolving balances, late payment fees, and foreign transaction margins for overseas use.

Statement clarity helps maintain the interest-free period up to 51 days on straight purchases, which requires paying the full statement on or before the due date. Internet Banking supports scheduled transfers, while the People’s Pay app enables quick, on-the-go payments and real-time balance checks.

Cash Deposit Machines accept repayments without teller queues, standing orders handle recurring minimums, and the branch network processes over-the-counter payments. E-statements are free, reducing paper clutter and ensuring delivery even while traveling.

Security and Overseas Use

Card security operates on layered controls: chip and PIN for point-of-sale, NFC Tap and Go for contactless, and one-time passwords through 3D Secure People’s Bank for e-commerce.

Transaction-level SMS alerts arrive after each swipe or online payment, offering immediate visibility and faster dispute reactions if something looks off. For international trips, eligible cards include free overseas travel insurance subject to policy terms, which typically activate when travel is paid using the card.

Contact details for card services should be saved in a phone and on a printed slip in luggage for emergencies. Card controls inside Internet Banking and the People’s Pay app allow quick temporary blocks, limit adjustments, or overseas enablement when crossing borders.

People’s Bank In Numbers

A snapshot of operational capacity gives context to scale, service reach, and public finances. Figures reflect recent highlights, including contributions to the Government of Sri Lanka and independent external ratings that speak to franchise strength.

Selected Operational Highlights:

| Metric | Figure |

| Years In Banking Service | Over 64 years |

| Number Of Outlets | 746 outlets |

| Number Of ATMs | 844 ATMs |

| Active Customers | Over 15.2 million |

| Total Assets Base | Over LKR 3.3 trillion |

Tips To Improve Approval Odds and Early Usage

Credit decisions rely on clear documentation, stable income signals, and a responsible credit history. These short, practical actions strengthen the file and smooth the first billing cycle.

- Align the requested limit to income and current obligations to reduce manual review.

- Keep salary slips, service letters, and business registrations recent, legible, and consistent.

- Pay the first statement in full to lock in the interest-free period and build positive history.

- Enable alerts, set spending limits, and track balances in the People’s Pay app daily.

- Use installment plans for large appliances or travel expenses instead of rolling balances.

Final Takeaway

Selecting the right tier, preparing precise documents, and enrolling in PEOPLE BANK online banking on day one produce a smoother credit experience.

Everyday benefits like installment plans, travel insurance on eligible tiers, NFC contactless, and consistent 3D Secure authentication make the card practical for stores and e-commerce.

Consistent on-time repayments, proactive limits, and strong documentation habits protect your credit profile and keep fees down throughout the account’s life.