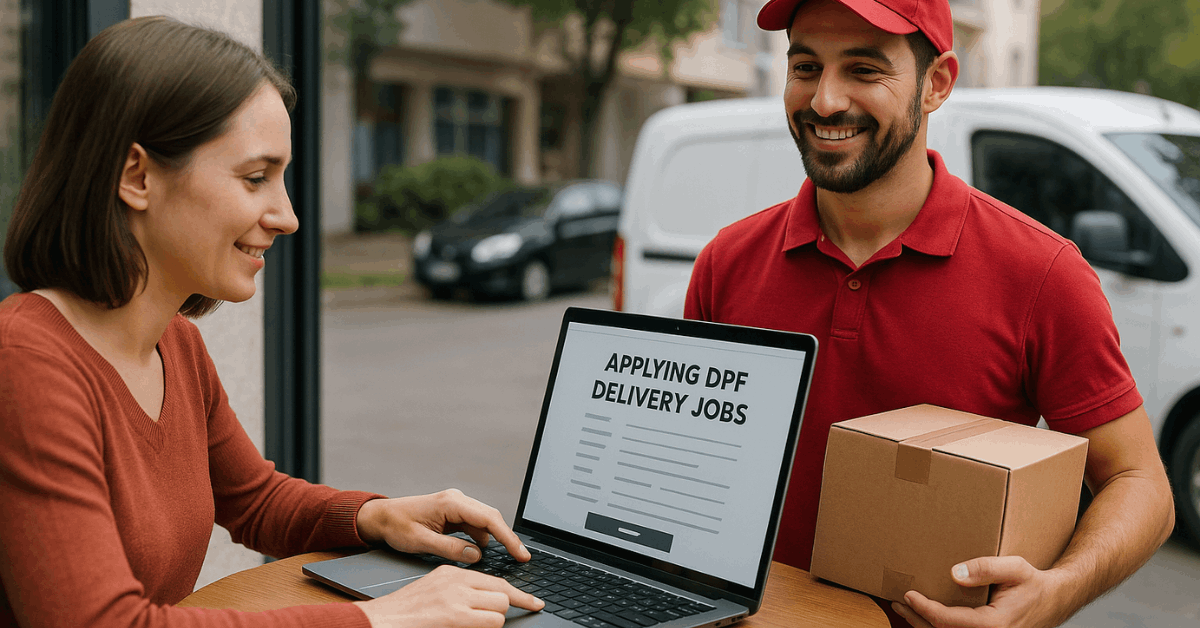

DPD offers reliable job opportunities for local drivers in the UK. These delivery roles are a smart option if you're looking for DPF delivery jobs that provide consistent work and competitive pay.

The company has multiple roles depending on your vehicle access and employment preference. Here's everything you need to know about becoming a successful driver.

What Is a DPD Delivery Job?

Delivery drivers working with this courier service transport parcels across local or regional areas. You choose from several contract types depending on your situation and goals. These jobs offer stable earnings and regular deliveries.

Different Roles Offered by DPD

Each type fits different schedules, goals, and vehicle availability. Choose the one that aligns with your current situation.

Owner Driver

This is for self-employed individuals who own or lease a van. You manage your taxes and insurance independently.

Earnings can reach £50K to £60K per route. The company offers vehicle branding and leasing support.

You decide how much you work and when. It's suited for drivers who want maximum control.

Owner Driver Worker

You remain self-employed but get employee-like benefits. This includes sick pay, paid holidays, and a pension.

You can lease a van or use your own. Annual earnings start at £27K.

This role is ideal if you want flexibility with some financial security. It’s a good middle ground between contractor and staff.

Employed Driver

As an employee, you get a fixed salary and benefits. The company provides the van and its maintenance.

The role includes holiday pay, sick leave, and a pension. The starting pay is around £ 24,000 per year.

It's best for those seeking a stable income. You focus entirely on deliveries without extra responsibilities.

Connect Delivery Driver

This is a flexible, app-based position. You use your own car and deliver in your local area.

Pay goes up to £18 per hour with weekly payouts. It's suitable for part-time workers or those with limited availability.

There’s no need for a van or long shifts. Ideal if you want local deliveries with control over your time.

How Much Can You Earn as a DPD Driver?

Your earnings depend on the role you choose. Some are based on routes, while others are based on hourly or yearly rates.

Payment Breakdown by Role

The company offers both fixed and flexible income models. You should know what each type pays before applying.

Owner Drivers

Highest earners with £50K to £60K per route annually. You control your workload and routes.

Taxes and insurance are your responsibility. This option is best for experienced drivers.

Owner Driver Workers

Start from £27K with added benefits. You earn slightly less but gain holiday and sick pay.

This model gives income stability without full employment. It suits people seeking moderate independence.

Employed Drivers

Start from £24K annually. All standard benefits are included. A van is provided, reducing overhead costs. Ideal for those seeking simplicity and structure.

Connect Drivers

Earn up to £18/hour with flexible scheduling. Pay is weekly, and you choose when to work.

This is a great side income or entry-level role. It suits people with personal vehicles and limited hours.

What Are the Requirements to Apply?

This job has basic but essential requirements. You need to be licensed, responsible, and eligible to work in the UK.

Key Application Requirements

Meeting the requirements ensures you start quickly and smoothly. Most roles follow the same core qualifications.

- You must hold a valid UK driving license for a minimum of 12 months. Your license should have minimal penalty points.

- You need a smartphone to access the driver app. This is crucial for managing delivery tasks.

- For Owner and Connect roles, a personal vehicle is required. Leasing options are available if you don’t own a van.

- Background checks and proof of eligibility to work in the UK are mandatory. Prepare to submit relevant documents.

What Will You Be Driving?

Your vehicle type determines the roles for which you qualify. The company supports drivers whether they own vehicles or not.

Vehicle Options for Drivers

You can use your own car, lease a van, or receive a company-provided vehicle. Here’s how it works for each role:

- Owner Drivers: Use personal vans or lease a Nissan, Maxus, or Ford. Livery branding is covered. Electric options are available.

- Owner-Operator Workers: Must use or lease a van, similar to owner-drivers. Electric van choices offer reduced fuel costs.

- Employed Drivers: Receive a company-owned van. Maintenance and branding are included. You focus on the job.

- Connect Drivers: Use your own personal car. This is the most flexible in terms of vehicle requirements.

How to Apply for a DPD Delivery Job?

The application process is simple and quick. Most steps are online and only take a few minutes.

Step-By-Step Application Process

Follow these steps to start your journey as a delivery driver:

- Visit the official DPD Careers Site

- Select the driver role that fits your needs. Each has a separate application form.

- Fill out your contact info and upload your license and work eligibility documents.

- Wait for contact from a recruiter or coordinator. They may request an interview or driving check.

- If accepted, attend a briefing or orientation session. Then, start delivering.

Tips to Maximize Your Success

Getting hired is just the first step. There are ways to enhance your earnings and improve your experience.

What to Prepare Before Applying?

Preparation helps you meet expectations and reduce delays.

- Ensure your driver's license is clean and up to date. Address any issues before applying.

- Verify that your vehicle meets the standards for the role. Leasing might be easier if your car is too old.

- Organize your documents in advance, including insurance and proof of address.

- Install the app used for deliveries and learn how it works. Familiarity with the platform is beneficial from day one.

Benefits of Working with DPD

This company supports drivers across every contract type. Each role includes perks to help you succeed.

Why Choose This Courier Company?

You get more than just a paycheck in this career.

- There are regular deliveries thanks to high parcel demand. This means fewer idle days.

- Driver support teams help with technical or route issues. You’re never left on your own.

- The app system keeps your deliveries organized. It also tracks mileage and payments.

- Lease options make it easy to get started even if you don't own a van.

Final Thoughts: Should You Apply to DPD?

This delivery job is a strong choice for those seeking flexibility, security, or high income. With multiple roles available, you can find a job that matches your lifestyle.

Whether you're looking for full-time employment or a side income, there's a setup for you. If you're ready to work and meet the basic requirements, it’s worth applying today.