Packing jobs in Japan is an excellent opportunity for locals and foreign workers seeking employment in a growing sector.

With the rise of e-commerce and logistics, the demand for packing workers is consistently high.

This guide covers the steps to apply for packing jobs in Japan, from finding listings to understanding visa requirements.

Understanding Packing Jobs in Japan

Packing jobs involve packaging products, labeling items, and ensuring quality control.

These positions are commonly found in e-commerce, retail, and manufacturing industries, where efficient packaging is crucial for product distribution.

Working Conditions

Packing jobs in Japan come with specific work environments and expectations. Here's a look at what you can expect:

- Shifts: Jobs may offer part-time or full-time work with flexible hours, including day and night shifts.

- Environment: Most positions are in warehouses or factory settings, which can be fast-paced and physically demanding.

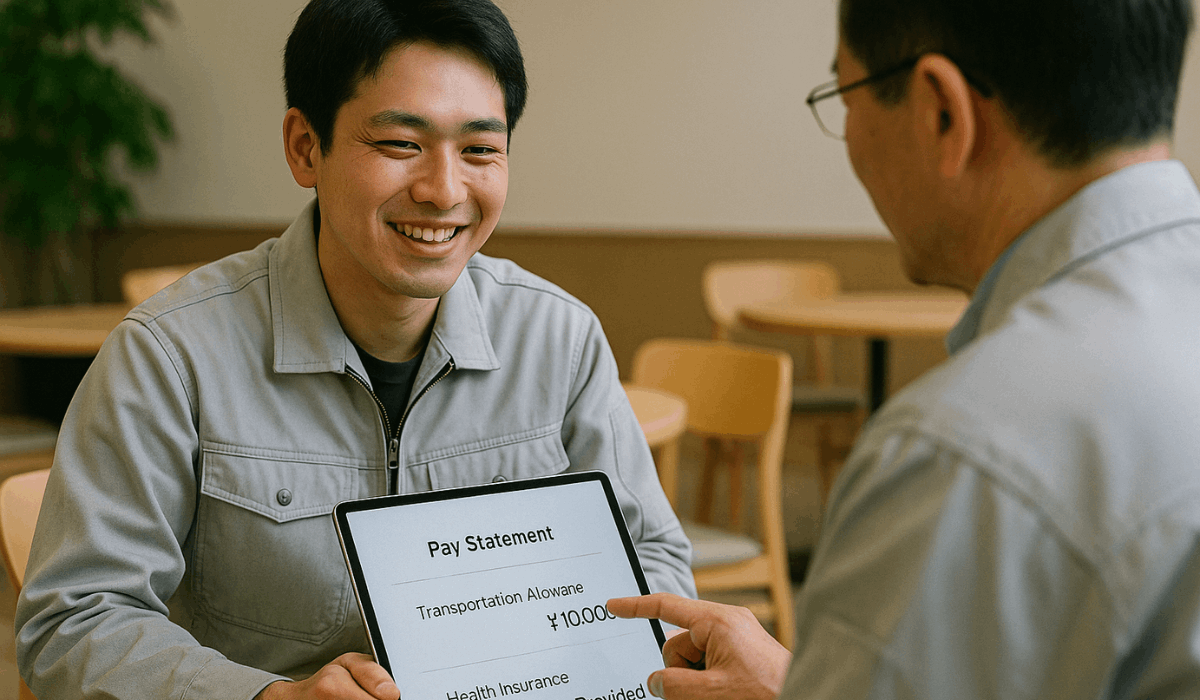

- Salary and Benefits: Expect hourly wages, potential overtime pay, health insurance, and other benefits like transportation allowances.

- Physical Demands: The work often involves standing and lifting heavy packages for long periods.

- Teamwork: You will usually work as a team, ensuring smooth operations in a collaborative setting.

Required Skills

Specific skills are essential to excelling in these roles. Here’s what you need to know:

- Attention to Detail: Ensuring products are packed correctly and accurately.

- Physical Stamina: Ability to stand for long hours and lift heavy boxes or items.

- Basic Japanese: Some roles may require basic communication in Japanese, especially for safety instructions and team coordination.

- Time Management: Efficiency in completing tasks within set timeframes.

- Teamwork: Collaboration with others in a fast-paced environment.

Where to Find Packing Jobs in Japan

There are several avenues to explore when looking for packing positions in Japan. Here’s where you can search for opportunities:

- Job Search Platforms: Popular websites like GaijinPot, Indeed Japan, and local job boards are great places to start.

- Temporary Agencies: Staffing agencies, such as Baito and Jobstreet, can help place workers in short-term or long-term positions.

- Direct Application: Many companies post job openings on their websites, where you can apply directly.

Applying for Packing Jobs

The application process for packing roles in Japan is straightforward, but there are key steps to follow. Here’s how to apply it effectively:

Prepare Your Documents:

- Resumé/CV: Tailor your CV to highlight relevant experience and skills.

- Cover Letter: Include a brief cover letter, if required, expressing your interest and qualifications.

- Required Documents: For foreign workers, ensure you have your visa, residence card, and other necessary documents.

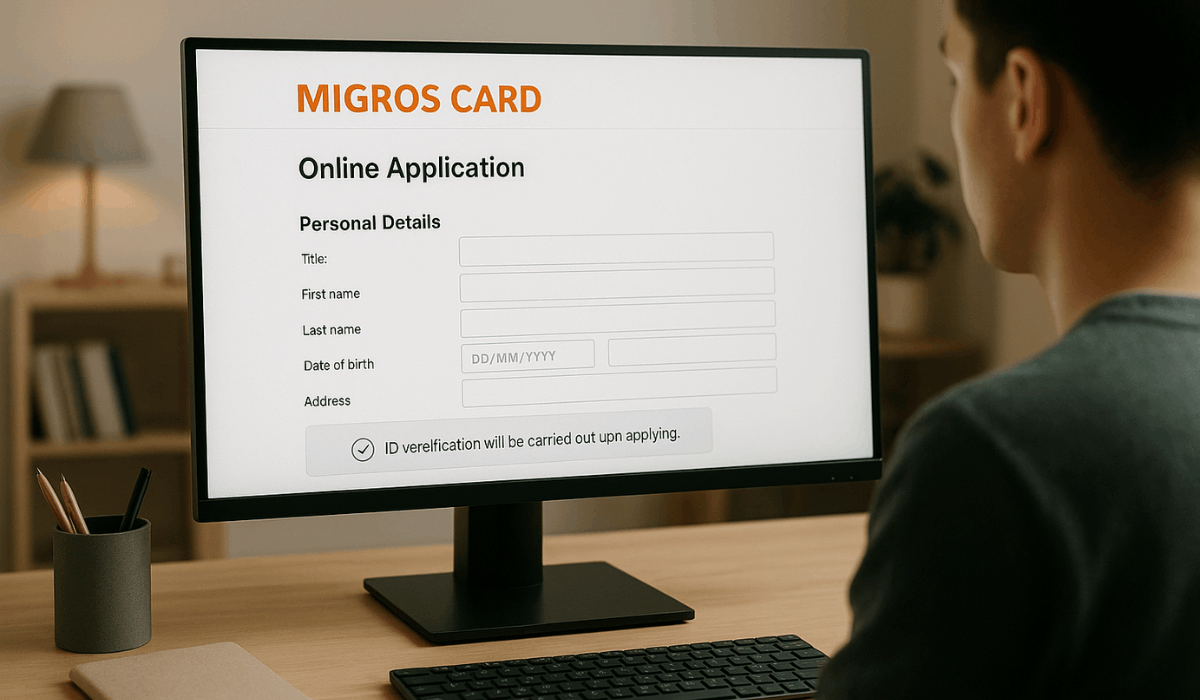

Online Application:

- Submit your application through job boards or directly on the company's website.

- Follow the instructions carefully and ensure that all required fields are completed.

Submit Through Agencies:

- If you are using a temporary staffing agency, please provide your CV and any necessary documents to the agency for job placement.

Prepare for the Interview:

- Dress professionally and arrive on time.

- Answer questions clearly, focusing on your experience and reliability.

- Be ready to discuss availability and willingness to work flexible hours.

Visa and Work Permit Requirements

Understanding visa and work permit requirements is essential for foreign workers seeking employment in Japan. Here's what you need to know:

Types of Visas:

- Work Visa: Those planning to stay long-term typically require a job offer from a Japanese employer.

- Temporary Worker Visa: Suitable for short-term employment, often used for seasonal or part-time positions.

Eligibility for Foreign Workers:

- You must meet specific criteria, such as a valid passport, proof of employment, and, in some cases, Japanese language proficiency.

Work Permit Process:

- Apply for a work permit through your employer or a Japanese embassy.

- The process involves submitting documents such as proof of employment, education, and language proficiency.

Residence Card:

- If you plan to stay in Japan for more than 90 days, you will need a residence card, which can be obtained upon arrival.

Renewing Visas:

- Work visas and permits can be extended with continued employment; however, renewal requires a separate application with supporting documents.

Employee Benefits

Packing jobs often come with various benefits that enhance the overall work experience. Here are the common benefits you can expect:

- Health Insurance: Coverage through the Japanese health insurance system or employer-provided insurance.

- Transportation Allowance: Some companies offer reimbursement for commuting costs.

- Paid Leave: Includes paid vacation days and public holidays.

- Overtime Pay: Compensation for hours worked beyond the regular schedule.

- Bonuses: Some employers offer seasonal or performance-based bonuses.

- Retirement Plans: Access to pension plans or contributions to Japan’s national pension system.

Salary Information

Packing roles in Japan offer competitive wages based on location, experience, and job type. Here's an overview:

Average Hourly Wage:

- Typically ranges from ¥1,150 to ¥2,248 per hour, depending on the region and employer.

Average Annual Salary:

- Warehouse Packer: Approximately ¥3,786,151 per year in Osaka, with entry-level positions starting around ¥2,907,587.

- Packer: Around ¥2,443,709 annually, ranging between ¥1,893,874 and ¥2,802,934.

- Warehouse Worker: An average of ¥3,623,430 per year, equating to about ¥1,742 per hour.

Shift Differentials:

- Night shifts and overtime may offer higher pay rates, typically ranging from ¥1,400 to ¥1,750 per hour.

Bonuses:

- Some employers offer annual bonuses, which can vary depending on the company's performance and individual contributions.

Tips for Getting Hired

Securing a packing role can be competitive, but following these tips can increase your chances of landing the position.

Here’s how you can stand out:

- Tailor Your Resume: Highlight relevant experience and skills, such as attention to detail and physical stamina.

- Learn Basic Japanese: Even a basic understanding of Japanese can give you an advantage in communication and understanding instructions.

- Be Flexible with Hours: Employers appreciate workers willing to work flexible hours, including nights or weekends.

- Show Reliability: Emphasize your punctuality, commitment, and ability to work in a team.

- Network: Connecting with others in the industry can help you discover unadvertised job opportunities.

- Prepare for the Interview: Be ready to answer questions about your work ethic, availability, and why you’re interested in the job.

Challenges to Expect

While packing jobs in Japan offer many opportunities, there are also challenges you should be prepared for.

Here are some of the common difficulties workers face:

- Physical Demands: The job frequently requires standing for extended periods, lifting heavy objects, and performing repetitive tasks.

- Fast-Paced Environment: You may need to keep up with a high volume of work, especially during peak seasons.

- Language Barriers: If you're not fluent in Japanese, understanding instructions and communicating with colleagues can be challenging.

- Long Hours: Some positions require overtime or late-night shifts, which can impact your work-life balance.

- Adjustment to Japanese Work Culture: Understanding Japan’s strong work ethic, punctuality, and hierarchical structure may take time.

To Sum Up

In conclusion, packing jobs in Japan offer excellent opportunities for those seeking stable employment in a growing sector.

Following the application steps and preparing for the challenges can increase your chances of securing a job in this field.

Start applying today through job platforms or staffing agencies to take the first step toward working in Japan's dynamic job market.