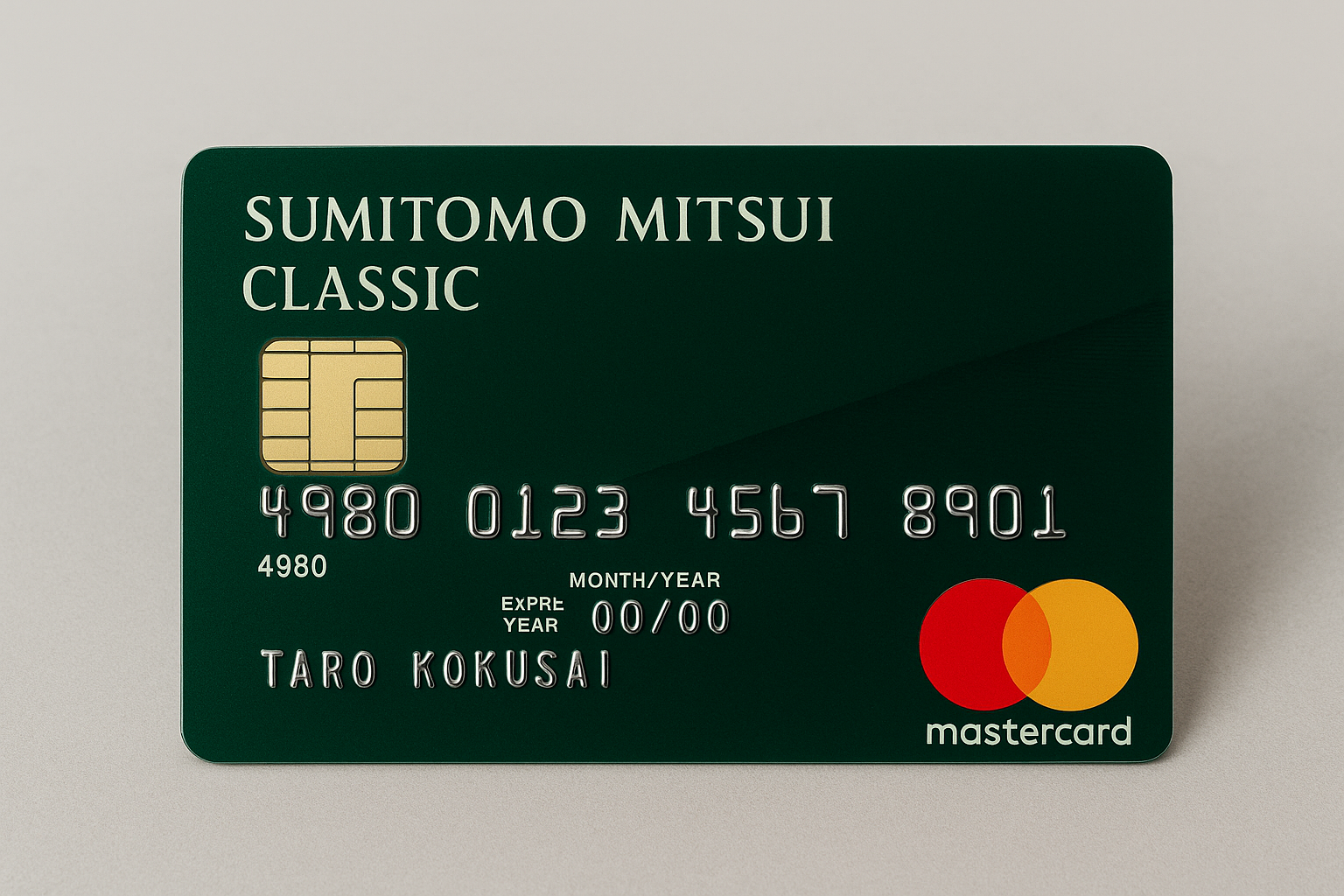

The Sumitomo Mitsui Classic credit card presents a reliable choice for discerning individuals in Japan seeking dependable and flexible credit solutions.

Known for its solid reputation, this card combines convenience, security, and a range of useful features tailored to everyday spending and travel needs.

This guide details the application procedure of Sumitomo Mitsui Classic, benefits, and features of the card.

Sumitomo Mitsui Classic Credit Card: Overview

Sumitomo Mitsui Banking Corporation (SMBC) in Japan introduces the Sumitomo Mitsui Classic Credit Card, a testament to its leading role in financial services.

Recognized globally for its broad range of banking solutions, SMBC enhances financial experiences for both individual and corporate clients. The Sumitomo Mitsui Classic Credit Card showcases SMBC’s dedication to innovation and superior customer service.

By integrating advanced banking technologies, the card ensures reliability and security, which is pivotal in building customer trust and satisfaction. This card, along with other services such as loans and investments, confirms SMBC's robust position in the financial sector.

Features of the Sumitomo Mitsui Classic Credit Card

The Sumitomo Mitsui Classic Credit Card is designed for the savvy cardholder in Japan, offering a blend of flexibility and top-tier security. This card stands out by meeting various customer preferences and requirements.

Key Features of the Sumitomo Mitsui Classic Credit Card

Starting with the basics, we listed for you the core benefits of the Sumitomo Mitsui Classic credit card.

- Credit Limit: The card provides a competitive credit limit, adjusted according to the cardholder's credit history and financial status in Japan.

- Rewards Programs: Cardholders benefit from diverse rewards programs. These include cash back, travel perks, and exclusive discounts at partner retailers.

- Security Measures: The card is equipped with advanced security technology, such as chip technology and continuous monitoring services, ensuring cardholders are safeguarded against fraud and theft.

Eligibility and Application Process

To successfully apply for the Sumitomo Mitsui Classic Credit Card in Japan, prospective cardholders need to know about the eligibility criteria and application steps. This section provides the essential details to ensure you are ready to proceed.

What Do You Need to Apply for the Sumitomo Mitsui Classic Credit Card?

Here are the essentials:

- Age: Applicants need to be at least 20 years old, as required by Japanese law.

- Residence: Applicants must reside in Japan or hold a valid residence permit.

- Income: It's essential to demonstrate a steady income to manage payments effectively.

- Credit History: A clean credit history, free of defaults or financial issues, is required.

Always confirm the latest details directly with Sumitomo Mitsui or their customer support.

Step 1: Access the Official Website

Start your application by visiting Sumitomo Mitsui’s official website.

You have the choice of standard card issuance or opting for immediate issuance, which may involve different limits and associated fees.

Make sure to thoroughly review and accept all terms and conditions before moving forward.

Step 2: Select Your Application Method

The Sumitomo Mitsui Classic Credit Card offers two application routes. You can apply online using the Vpass system, or you can fill out a physical form where you can also choose your card's design.

In both cases, you'll need to provide comprehensive details about your personal and financial background, including employment, family, and your financial status, such as income and expenses.

Tip: Always double-check the information you provide to avoid any delays in your application process.

Step 3: Finalize Your Application

Proceed by following the on-site instructions to complete your application. This process may include identity verification or the submission of additional documents.

Warning: It's crucial to ensure all documents are accurate and up-to-date to avoid any issues with the approval of your application.

Once you've initiated your application for the Sumitomo Mitsui Classic Credit Card, the website will direct you through the necessary steps to complete it.

For Japanese applicants, typical documentation required includes:

- Identification: Provide a copy of a valid ID, such as your passport or driver's license.

- Income Verification: Submit evidence of your income, like a bank statement or pay stub.

- Address Proof: Include a document verifying your address, such as a utility bill or rental agreement.

- Employment Details: Share details about your job, including your employer and your position.

Required Documents

Securing the correct documentation is vital. In Japan, make sure you gather:

- Government-issued ID: Needed for identity verification.

- Proof of Income: Examples include recent pay slips or tax returns.

- Proof of Address: Documents like a utility bill or lease agreement are acceptable.

- Additional Documentation: Depending on your financial circumstances, more documents may be required to support your application.

Interest Rates and Fees

Grasping the interest rates and fees of the Sumitomo Mitsui Classic credit card is essential for anyone aiming to optimize their financial strategies in Japan. This section details various charges one might face as a cardholder.

Interest Rates Details

For purchases, the interest rate on the Sumitomo Mitsui Classic credit card generally spans from 15.0% to 18.0%, influenced by factors such as credit history.

For cash advances, the rate typically varies between 15.0% and 20.0%, reflecting the heightened risk of cash transactions. Being aware of these rates aids in better managing both purchases and cash withdrawals.

Annual Fees and Waivers

The annual fee for the Sumitomo Mitsui Classic credit card may differ based on the card type and customer segment.

In some cases, meeting specific criteria, like achieving a designated spending level annually, could lead to a waiver of this fee.

Staying informed about these conditions can help leverage potential savings, significantly lowering the expense of holding this credit card.

Other Charges

Additional fees include charges for late payments and exceeding the credit limit. Late payment fees apply when the minimum payment is not met by the set deadline.

If spending surpasses the established credit limit, over-limit fees are assessed.

Monitoring expenditures and maintaining timely payments are critical practices to sidestep these avoidable costs.

How to Use Your Card Correctly

Managing your Sumitomo Mitsui Classic Credit Card efficiently is crucial in Japan, where financial health is highly valued. To ensure you maintain a strong credit score and minimize financial stress, adhere to these guidelines:

- Make sure to pay at least the minimum due amount on your card each month. If possible, pay more to reduce interest costs.

- Set up automatic payments for your Sumitomo Mitsui Classic Credit Card to prevent missing any payment deadlines.

- Regularly check your card statements to monitor expenses and guard against fraudulent transactions.

- Enable alerts to keep your credit balance and upcoming payment dates updated.

To maximize the advantages of your Sumitomo Mitsui Classic Credit Card, implement these strategies:

- Use your card for everyday purchases to accumulate rewards points rapidly.

- Get familiar with the rewards catalog to spend your points in the most beneficial way.

- Utilize any insurance benefits that come with your card, like travel or purchase protection, to safeguard your expenditures.

- Keep an eye out for exclusive promotions or discounts for cardholders to boost your savings and overall card benefits.

Contact for Inquiries

To get in touch with Sumitomo Mitsui Banking Corporation, dial 81-3-3282-8111. This contact number connects you directly to their main branch in Tokyo, ensuring swift assistance for your inquiries.

Main Branch Address

Located at 1-1-2, Marunouchi, Chiyoda-ku, in the heart of Tokyo, Japan, the main branch of Sumitomo Mitsui Banking Corporation serves as a key site in Tokyo's bustling financial district.

This central location is not only pivotal for local operations but also caters to both local and international clients, reflecting the bank's global scope and dedication to customer service.

Disclaimer

While this article aims to present current and accurate information regarding contact details and location, please be aware that changes to rates and terms may occur without prior notice.

It is advisable to confirm these details directly with official bank sources to make informed decisions related to your financial needs.

Conclusion

Sumitomo Mitsui Classic credit card offers a straightforward online application process, enabling efficient financial management and access to numerous benefits for residents in Japan.

This process allows applicants to apply at their convenience, regardless of time or location. Support is readily available through the bank’s main branch and customer service, ensuring that applicants have the assistance they need.

As financial tools advance, the Sumitomo Mitsui Classic credit card continues to be a dependable choice for personal finance management in Japan.