Engelliler için erişilebilirlik denetimlerinde yeni kurallar geliyor

Aile, Çalışma ve Toplumsal Hizmetler Bakanlığı, engellilerin, yaşlıların ve hareket kısıtlılığı bulunan vatandaşların erişilebilirlik kontrollerinde yeni kıstasların dikkate alındığı, daha faal bir süreci başlatacak.

Bakanlık, Cumhurbaşkanı Recep Tayyip Erdoğan tarafından ilan edilen "2020 Erişilebilirlik Yılı" çalışmaları kapsamında "Erişilebilirlik herkes içindir" prensibiyle yürütülen çalışmalarını sürdürüyor.

Başta engelliler, yaşlılar olmak üzere hareket kısıtlılığı bulunan tüm bireylerin kamuya açık alanlar ve yapılarla toplu taşıma araçlarını rahat bir formda kullanabilmesi emeliyle yürütülen erişilebilirlik kontrollerinin yaygınlaştırılması ve daha aktif hale getirilmesi için yeni bir adım atıldı.

Aile, Çalışma ve Toplumsal Hizmetler Bakanı Zehra Zümrüt Selçuk imzasıyla yayımlanan yeni genelge ile tüm vilayetlerde erişilebilirlik kontrollerinde kullanılan ve birebir vakitte bina, açık alan ve toplu taşıma araçlarında yapılacak erişilebilirlik uygulamaları için rehber olma niteliği de taşıyan formlarda revizyona gidildi.

Valilikler bünyesinde misyon yapan, kamu kurumu temsilcilerinin yanı sıra engellilere yönelik hizmet veren sivil toplum kuruluşlarından üyelerin de yer aldığı Erişilebilirlik İzleme ve Denetleme Kurullarının kontrollerde kullanacağı yeni formlarda, Yapı Kontrolü Uygulama Yönetmeliği'nde 30 Mayıs 2019'da yapılan erişilebilirlik revizyonları ve asansörlerle ilgili şimdiki mevzuat temel alındı.

Geniş erişilebilir tuvaletler mecburî hale getirilecek

Bu kapsamda, özel kesimin yanı sıra 1 Ocak 2021'den sonra bina proje onayı yahut yapı müsaadesini alacak kamu binaları ile kamuya ilişkin cümbüş ve tema parkı, yüzme havuzu, AVM, YHT istasyonu üzere alanlardaki engelli tuvaletlerinde yeni kıstaslar zarurî tutulacak ve kontrolleri gerçekleştirilecek.

Düzenlemelere nazaran, 800 metrekareden büyük kullanım alanı bulunan yapı kontrolüne tabi binalarda yapılacak engelli tuvaletleri için akülü sandalye, standartlardan büyük tekerlekli sandalye ve sağ yahut sol kısımda hareket kaybı olanlara yönelik kullanımın kolaylaştırılması için istenen tuvalet büyüklüğü gereklilikleri; 1 Ocak 2021‘den sonra bina proje onayı yahut yapı müsaadesini alan kamu binalarında da aranmaya başlayacak.

Kamuya ilişkin AVM, cümbüş ve tema parkı, büyük spor merkezi, yüzme havuzu, 500'den fazla izleyici kapasiteli bina, otobüs terminali, deniz terminali, ana tren istasyonu, YHT istasyonu ile havalimanı üzere yerlerde ise hareket alanı ve kapı genişliği sedye girişine de imkan sağlayacak biçimde, yetişkin için bir adet alt değiştirme ünitesi bulunan geniş erişilebilir tuvaletler zarurî hale getirilecek.

Ayrıca konferans, sahne sanatları, toplantı, sinema salonlarında tekerlekli sandalye için yer ayrılması ve muhakkak sayıda koltukta indüksiyon döngü sisteminin kurulması da mecburî olacak.

Binalarda "sarı iz" ölçütleri belirlendi

Revizyonla konut alanlarında kamu kullanımına açık hizmet veren ofis, ofis üzere yerlerin ve bunların kontrollerinde aranacak genel erişilebilirlik kuralları için de yeni kontrol unsurları getirildi.

Ayrıca görme engeliler için "sarı iz" olarak da tanımlanan "hissedilebilir yürüme yüzeyi" işaretlerinin hangi çeşit binada nasıl uygulanacağına ait ölçütler belirlendi.

Toplu taşıma araçlarında "sesli anons" sistemi denetlenecek

Açık alanlar ve toplu taşıma araçları için de kurum ve kuruluşlardan alınan görüşler ile BM Engellilerin Haklarına Ait Kontrat kapsamındaki gerekliliklerle ilgili yapılan düzenlemelerle otobüslerde varılacak durağın isminin sesli olarak anons edilmesi ve yazılı olarak belirtilmesi, metro vagonlarında güzergah bilgisi, durak bilgisi, kalkış saati, seyahat mühleti ve varış saati üzere bilgilerin sesli olarak anonsu ve yazılı bilgilendirmenin yapılmasına ait kıstaslar da kontrole tabi tutulacak.

Revizyon kapsamında formlarda yaşlıların binaları ve açık alanları kullanırken gereksinim duyduğu kimi erişilebilirlik gereklilikleri de yer aldı.

Denetim çalışmaları hızlanacak

Erişilebilirlik İzleme ve Denetleme Komitelerince yapılan kontroller sonucunda erişilebilir olduğu tespit edilen bina, açık alan kullanımları ve toplu taşıma araçları için valilikler tarafından "Erişilebilirlik Belgesi" düzenleniyor.

Yeni düzenlemelerle erişilebilirlik uygulamalarının yaygınlaşması ve engellilerin toplumsal yaşama iştiraklerinin artırılmasına katkı sağlanması hedefleniyor. Kontrol formlarının revizyonu ile birlikte kurum ve kuruluşların var olan hizmet binalarının dönüşümü ve yeni yapılan projelerin standartlara uygun olmasına yönelik erişilebilirlik çalışmalarına sürat verilecek.

3101 Nitelik Kodu Nedir ?

3101 Nitelik Kodu Nedir ?

Atanmak isteyen engelli/normal adaylar ön lisans ile tercih verirler branş olarak kılavuzda tercih verip toplam 30 adet tercihini doldurulmayan yada kpss/ ekpss tercihlerinde okuduğu bölümlerde (Branştan) alımlar olmadığı için adaylarımız 3101 kod ile tercihlerini veriyorlar.

Kpss ÖnLisans 3101 Nitelik Kodu Nedir ?

3101 Nitelik Kodu kpss ile normal memur olarak tercih yapabilecek bir nitelik kodudur. 3101 Nitelik Kodu .'' Bitki Koruma önlisans programından mezun olmak '' alım yapmaktadır.

Ekpss ÖnLisans 3101 Nitelik Kodu Nedir ?

3101 Nitelik Kodu ekpss ile normal memur olarak tercih yapabilecek bir nitelik kodudur. 3101 Nitelik Kodu '' Bitki Koruma önlisans programından mezun olmak '' alım yapmaktadır.

Ekpss tercih yapmadan önce bilinmesi gerekenler

Ekpss Atama Sayıları Ne Kadardır ?

EKPSS-2016/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 41.294 | 2.514 | 2.466 | 48 |

| Önlisans | 7.785 | 1.340 | 1.233 | 107 |

| Lisans | 5.525 | 1.039 | 893 | 146 |

EKPSS-2016/2 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 1.049.015 | 151 | 151 | 0 |

| Önlisans | 752 | 752 | 0 | 0 |

| Lisans | 257.431 | 1.148 | 1.148 | 0 |

EKPSS-2017/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 30.033 | 444 | 386 | 58 |

| Önlisans | 5.408 | 507 | 458 | 49 |

| Lisans | 3.379 | 1.348 | 1.273 | 75 |

EKPSS-2018/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 23.178 | 540 | 502 | 38 |

| Önlisans | 4.211 | 531 | 465 | 66 |

| Lisans | 1.897 | 1.100 | 854 | 246 |

EKPSS-2018/2 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 44049 | 534 | 534 | 0 |

| Önlisans | 8785 | 773 | 1723 | 50 |

| Lisans | 5663 | 999 | 846 | 153 |

EKPSS-2019 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 27.730 | 396 | 396 | 0 |

| Önlisans | 5.845 | 448 | 428 | 20 |

| Lisans | 3.193 | 295 | 217 | 78 |

Ekpss Kura ile Yerleşme

Ekpss Ön Lisans 3101 Nitelik Kodu ile Tercih Yapmak

Sorunun Cevabı her zaman bellidir. Bilemeyiz neden derseniz atama bu her 2 yılda yapılan sınav yüksek puanlılar da var az puanlılarda ama böyle bir durum var arkadaşlar ekpss ile giren kardeşlerimiz bazen sadece 2 yada 5 tercih yapmak zorunda kalıyor sebebi ise engelinden dolayı yakın illeri yazabilir mesela Çanakkale'de yaşayan biri tutup tercihinde Ağrıyı yazmıyorlar bazen. Bundan dolayı birazda şans işidir ve İyi tercih ile en düşük puan alan arkadaşlar da atanabilirler. Konuyla İlgili Tüm Sorularınızı Aşağıda Bulunan Yorum Kısmından Sorabilirsiniz. Ayrıca Lütfen yıldız vermeyi unutmayın. İyi günler iyi atamalar dileğiyle...

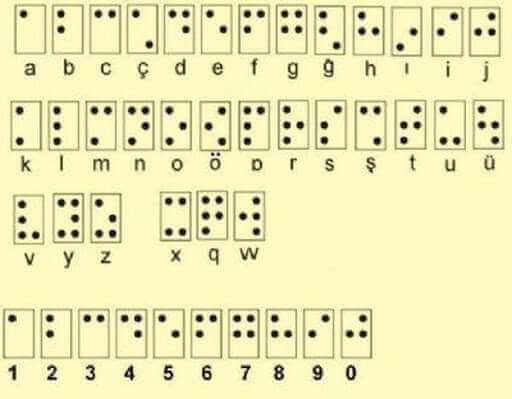

Braille Alfabesi Nedir ve Nasıl Okunur

Makale Konuları

Braille Alfabesi

Braille alfabesi görme engellilerin okuyup yazması için geliştirilen özel bir alfabedir. 1821 yılında Fransız mucit olan Louis Braille tarafından geliştirilmiştir.

Braille Alfabesi Nedir?

Louis Braille 3 yaşında iken sol gözünün hasar görmesinin ardından bu gözünde görme yetisini tamamen kaybeder. Sonrasında sempatetikoftalmiya (bir çeşit göz hastalığı) sağ gözünü de etkiler ve 6 yaşında diğer gözünü de kaybederek tamamen kör olur. Louis Braille ailesinin desteği ile okuma yazmayı öğrenip 7 yaşında iken Royaledes Jeunes Aveugles (Genç Körler Kraliyet Enstitüsü)’den burs kazanır. Görme engellilerin hissedebilmesi için kabartılmış harf sisteminin kullanıldığı okullarda öğrenciler okuma ve yazma öğrenmekte zorluk çekiyor, kısa bir yazının okunması bile uzun zaman alıyordu. Bu durum üzerine Louis Braille daha iyi bir yöntem için çalışmalara başladı.

Napolyon’un talebi üzerine hazırlanmış olan askerlerin karanlıkta, ışık olmaksızın iletişim kurmalarını sağlamak için geliştirilmiş olan sistemdeki hataları tespit eden Louis Braille sistemdeki en büyük hatanın alfabedeki harflerin parmak hareketleri olmaksızın anlaşılamaması olduğunu söyledi. Louis Braille bu sistem üzerinde çalışarak her birinde üç nokta olan paralel iki kolonun yer aldığı altı noktalı sistemi geliştirdi.

Bir kağıt üzerine iğne ile yazılabilen harflerin yanı sıra sayı, bağlaç ya da noktalama işaretlerinin de belirtilebildiği sistem öğrencilerin harfleri daha rahat hissedebilmelerine olanak verdiği için görme engellilerin okuma ve yazmayı öğrenmesi daha kolaylaşmış oldu. Eğitim aldığı okulda öğretmenlikte yapan Louis Braille oluşturduğu alfabe ile kitaplar da yazdı. Yazılan ilk kitap 1827 yılında basılmıştır. Louis Braille 43 yaşında tüberküloz nedeniyle hayatını kaybetmiştir.

Braille Alfabesi Nasıl Yazılır?

Oldukça basit bir temel mantığı olan Braille alfabesi noktalardan oluşmaktadır. 6 noktadan oluşan kombinasyonlarda her sütunda yer alan bir noktanın ya da birkaç noktanın dolu veya işaretli olması sayesinde okuma gerçekleştirilir. Bu sayede 26 farklı kombinasyona sahip olan alfabenin 64 tane farklı kombinasyonu bulunabilmektedir.

Braille Alfabesi Nasıl Okunur?

Braille Alfabesini okumak için alfabenin gösterdiği karakterleri öğrenmek gerekmektedir. Örneğin üsteki iki nokta kabartıldığında C harfi olurken bu karakterden önce sol alttaki noktanın ve sağdaki 3 noktanın kabartıldığı ‘sayı’ işareti varsa bu kabartma şekli 3 sayısını ifade etmektedir.

3013 Nitelik Kodu Nedir ?

3013 Nitelik Kodu Nedir ?

Atanmak isteyen engelli/normal adaylar ön lisans ile tercih verirler branş olarak kılavuzda tercih verip toplam 30 adet tercihini doldurulmayan yada kpss/ ekpss tercihlerinde okuduğu bölümlerde (Branştan) alımlar olmadığı için adaylarımız 3013 kod ile tercihlerini veriyorlar.

Kpss ÖnLisans 3013 Nitelik Kodu Nedir ?

3013 Nitelik Kodu kpss ile normal memur olarak tercih yapabilecek bir nitelik kodudur. 3013 Nitelik Kodu .'' Diş Protez, Diş Protez Teknikerliği, Diş Protez '' alım yapmaktadır.

Ekpss ÖnLisans 3013 Nitelik Kodu Nedir ?

3013 Nitelik Kodu ekpss ile normal memur olarak tercih yapabilecek bir nitelik kodudur. 3013 Nitelik Kodu '' Diş Protez, Diş Protez Teknikerliği, Diş Protez '' alım yapmaktadır.

Ekpss tercih yapmadan önce bilinmesi gerekenler

Ekpss Atama Sayıları Ne Kadardır ?

EKPSS-2016/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 41.294 | 2.514 | 2.466 | 48 |

| Önlisans | 7.785 | 1.340 | 1.233 | 107 |

| Lisans | 5.525 | 1.039 | 893 | 146 |

EKPSS-2016/2 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 1.049.015 | 151 | 151 | 0 |

| Önlisans | 752 | 752 | 0 | 0 |

| Lisans | 257.431 | 1.148 | 1.148 | 0 |

EKPSS-2017/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 30.033 | 444 | 386 | 58 |

| Önlisans | 5.408 | 507 | 458 | 49 |

| Lisans | 3.379 | 1.348 | 1.273 | 75 |

EKPSS-2018/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 23.178 | 540 | 502 | 38 |

| Önlisans | 4.211 | 531 | 465 | 66 |

| Lisans | 1.897 | 1.100 | 854 | 246 |

EKPSS-2018/2 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 44049 | 534 | 534 | 0 |

| Önlisans | 8785 | 773 | 1723 | 50 |

| Lisans | 5663 | 999 | 846 | 153 |

EKPSS-2019 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 27.730 | 396 | 396 | 0 |

| Önlisans | 5.845 | 448 | 428 | 20 |

| Lisans | 3.193 | 295 | 217 | 78 |

Ekpss Kura ile Yerleşme

Ekpss Ön Lisans 3013 Nitelik Kodu ile Tercih Yapmak

Sorunun Cevabı her zaman bellidir. Bilemeyiz neden derseniz atama bu her 2 yılda yapılan sınav yüksek puanlılar da var az puanlılarda ama böyle bir durum var arkadaşlar ekpss ile giren kardeşlerimiz bazen sadece 2 yada 5 tercih yapmak zorunda kalıyor sebebi ise engelinden dolayı yakın illeri yazabilir mesela Çanakkale'de yaşayan biri tutup tercihinde Ağrıyı yazmıyorlar bazen. Bundan dolayı birazda şans işidir ve İyi tercih ile en düşük puan alan arkadaşlar da atanabilirler. Konuyla İlgili Tüm Sorularınızı Aşağıda Bulunan Yorum Kısmından Sorabilirsiniz. Ayrıca Lütfen yıldız vermeyi unutmayın. İyi günler iyi atamalar dileğiyle...

3009 Nitelik Kodu Nedir ?

3009 Nitelik Kodu Nedir ?

Atanmak isteyen engelli/normal adaylar ön lisans ile tercih verirler branş olarak kılavuzda tercih verip toplam 30 adet tercihini doldurulmayan yada kpss/ ekpss tercihlerinde okuduğu bölümlerde (Branştan) alımlar olmadığı için adaylarımız 3009 kod ile tercihlerini veriyorlar.

Kpss ÖnLisans 3009 Nitelik Kodu Nedir ?

3009 Nitelik Kodu kpss ile normal memur olarak tercih yapabilecek bir nitelik kodudur. 3009 Nitelik Kodu Ameliyathane Teknikerliği, Cerrahi Teknikerliği, Ameliyathane Hizmetleri, Cerrahi önlisans programlarının birinden mezun olmak.'' alım yapmaktadır.

Ekpss ÖnLisans 3009 Nitelik Kodu Nedir ?

3009 Nitelik Kodu ekpss ile normal memur olarak tercih yapabilecek bir nitelik kodudur. 3009 Nitelik Kodu Ameliyathane Teknikerliği, Cerrahi Teknikerliği, Ameliyathane Hizmetleri, Cerrahi önlisans programlarının birinden mezun olmak.'' alım yapmaktadır.

Ekpss tercih yapmadan önce bilinmesi gerekenler

Ekpss Atama Sayıları Ne Kadardır ?

EKPSS-2016/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 41.294 | 2.514 | 2.466 | 48 |

| Önlisans | 7.785 | 1.340 | 1.233 | 107 |

| Lisans | 5.525 | 1.039 | 893 | 146 |

EKPSS-2016/2 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 1.049.015 | 151 | 151 | 0 |

| Önlisans | 752 | 752 | 0 | 0 |

| Lisans | 257.431 | 1.148 | 1.148 | 0 |

EKPSS-2017/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 30.033 | 444 | 386 | 58 |

| Önlisans | 5.408 | 507 | 458 | 49 |

| Lisans | 3.379 | 1.348 | 1.273 | 75 |

EKPSS-2018/1 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 23.178 | 540 | 502 | 38 |

| Önlisans | 4.211 | 531 | 465 | 66 |

| Lisans | 1.897 | 1.100 | 854 | 246 |

EKPSS-2018/2 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 44049 | 534 | 534 | 0 |

| Önlisans | 8785 | 773 | 1723 | 50 |

| Lisans | 5663 | 999 | 846 | 153 |

EKPSS-2019 Yerleştirme Sonuçlarına İlişkin Sayısal Bilgiler

| Öğrenim Türü | Tercih Yapan Aday Sayısı | Kontenjan Sayısı | Yerleşen Aday Sayısı | Boş Kalan Kontenjan Sayısı |

| Ortaöğretim | 27.730 | 396 | 396 | 0 |

| Önlisans | 5.845 | 448 | 428 | 20 |

| Lisans | 3.193 | 295 | 217 | 78 |

Ekpss Kura ile Yerleşme

Ekpss Ön Lisans 3009 Nitelik Kodu ile Tercih Yapmak

Sorunun Cevabı her zaman bellidir. Bilemeyiz neden derseniz atama bu her 2 yılda yapılan sınav yüksek puanlılar da var az puanlılarda ama böyle bir durum var arkadaşlar ekpss ile giren kardeşlerimiz bazen sadece 2 yada 5 tercih yapmak zorunda kalıyor sebebi ise engelinden dolayı yakın illeri yazabilir mesela Çanakkale'de yaşayan biri tutup tercihinde Ağrıyı yazmıyorlar bazen. Bundan dolayı birazda şans işidir ve İyi tercih ile en düşük puan alan arkadaşlar da atanabilirler. Konuyla İlgili Tüm Sorularınızı Aşağıda Bulunan Yorum Kısmından Sorabilirsiniz. Ayrıca Lütfen yıldız vermeyi unutmayın. İyi günler iyi atamalar dileğiyle...

Sumitomo Mitsui Classic Credit Card: Apply Now

The Sumitomo Mitsui Classic credit card presents a reliable choice for discerning individuals in Japan seeking dependable and flexible credit solutions.

Known for its solid reputation, this card combines convenience, security, and a range of useful features tailored to everyday spending and travel needs.

This guide details the application procedure of Sumitomo Mitsui Classic, benefits, and features of the card.

Sumitomo Mitsui Classic Credit Card: Overview

Sumitomo Mitsui Banking Corporation (SMBC) in Japan introduces the Sumitomo Mitsui Classic Credit Card, a testament to its leading role in financial services.

Recognized globally for its broad range of banking solutions, SMBC enhances financial experiences for both individual and corporate clients. The Sumitomo Mitsui Classic Credit Card showcases SMBC’s dedication to innovation and superior customer service.

By integrating advanced banking technologies, the card ensures reliability and security, which is pivotal in building customer trust and satisfaction. This card, along with other services such as loans and investments, confirms SMBC's robust position in the financial sector.

Features of the Sumitomo Mitsui Classic Credit Card

The Sumitomo Mitsui Classic Credit Card is designed for the savvy cardholder in Japan, offering a blend of flexibility and top-tier security. This card stands out by meeting various customer preferences and requirements.

Key Features of the Sumitomo Mitsui Classic Credit Card

Starting with the basics, we listed for you the core benefits of the Sumitomo Mitsui Classic credit card.

- Credit Limit: The card provides a competitive credit limit, adjusted according to the cardholder's credit history and financial status in Japan.

- Rewards Programs: Cardholders benefit from diverse rewards programs. These include cash back, travel perks, and exclusive discounts at partner retailers.

- Security Measures: The card is equipped with advanced security technology, such as chip technology and continuous monitoring services, ensuring cardholders are safeguarded against fraud and theft.

Eligibility and Application Process

To successfully apply for the Sumitomo Mitsui Classic Credit Card in Japan, prospective cardholders need to know about the eligibility criteria and application steps. This section provides the essential details to ensure you are ready to proceed.

What Do You Need to Apply for the Sumitomo Mitsui Classic Credit Card?

Here are the essentials:

- Age: Applicants need to be at least 20 years old, as required by Japanese law.

- Residence: Applicants must reside in Japan or hold a valid residence permit.

- Income: It's essential to demonstrate a steady income to manage payments effectively.

- Credit History: A clean credit history, free of defaults or financial issues, is required.

Always confirm the latest details directly with Sumitomo Mitsui or their customer support.

Step 1: Access the Official Website

Start your application by visiting Sumitomo Mitsui’s official website.

You have the choice of standard card issuance or opting for immediate issuance, which may involve different limits and associated fees.

Make sure to thoroughly review and accept all terms and conditions before moving forward.

Step 2: Select Your Application Method

The Sumitomo Mitsui Classic Credit Card offers two application routes. You can apply online using the Vpass system, or you can fill out a physical form where you can also choose your card's design.

In both cases, you'll need to provide comprehensive details about your personal and financial background, including employment, family, and your financial status, such as income and expenses.

Tip: Always double-check the information you provide to avoid any delays in your application process.

Step 3: Finalize Your Application

Proceed by following the on-site instructions to complete your application. This process may include identity verification or the submission of additional documents.

Warning: It's crucial to ensure all documents are accurate and up-to-date to avoid any issues with the approval of your application.

Once you've initiated your application for the Sumitomo Mitsui Classic Credit Card, the website will direct you through the necessary steps to complete it.

For Japanese applicants, typical documentation required includes:

- Identification: Provide a copy of a valid ID, such as your passport or driver's license.

- Income Verification: Submit evidence of your income, like a bank statement or pay stub.

- Address Proof: Include a document verifying your address, such as a utility bill or rental agreement.

- Employment Details: Share details about your job, including your employer and your position.

Required Documents

Securing the correct documentation is vital. In Japan, make sure you gather:

- Government-issued ID: Needed for identity verification.

- Proof of Income: Examples include recent pay slips or tax returns.

- Proof of Address: Documents like a utility bill or lease agreement are acceptable.

- Additional Documentation: Depending on your financial circumstances, more documents may be required to support your application.

Interest Rates and Fees

Grasping the interest rates and fees of the Sumitomo Mitsui Classic credit card is essential for anyone aiming to optimize their financial strategies in Japan. This section details various charges one might face as a cardholder.

Interest Rates Details

For purchases, the interest rate on the Sumitomo Mitsui Classic credit card generally spans from 15.0% to 18.0%, influenced by factors such as credit history.

For cash advances, the rate typically varies between 15.0% and 20.0%, reflecting the heightened risk of cash transactions. Being aware of these rates aids in better managing both purchases and cash withdrawals.

Annual Fees and Waivers

The annual fee for the Sumitomo Mitsui Classic credit card may differ based on the card type and customer segment.

In some cases, meeting specific criteria, like achieving a designated spending level annually, could lead to a waiver of this fee.

Staying informed about these conditions can help leverage potential savings, significantly lowering the expense of holding this credit card.

Other Charges

Additional fees include charges for late payments and exceeding the credit limit. Late payment fees apply when the minimum payment is not met by the set deadline.

If spending surpasses the established credit limit, over-limit fees are assessed.

Monitoring expenditures and maintaining timely payments are critical practices to sidestep these avoidable costs.

How to Use Your Card Correctly

Managing your Sumitomo Mitsui Classic Credit Card efficiently is crucial in Japan, where financial health is highly valued. To ensure you maintain a strong credit score and minimize financial stress, adhere to these guidelines:

- Make sure to pay at least the minimum due amount on your card each month. If possible, pay more to reduce interest costs.

- Set up automatic payments for your Sumitomo Mitsui Classic Credit Card to prevent missing any payment deadlines.

- Regularly check your card statements to monitor expenses and guard against fraudulent transactions.

- Enable alerts to keep your credit balance and upcoming payment dates updated.

To maximize the advantages of your Sumitomo Mitsui Classic Credit Card, implement these strategies:

- Use your card for everyday purchases to accumulate rewards points rapidly.

- Get familiar with the rewards catalog to spend your points in the most beneficial way.

- Utilize any insurance benefits that come with your card, like travel or purchase protection, to safeguard your expenditures.

- Keep an eye out for exclusive promotions or discounts for cardholders to boost your savings and overall card benefits.

Contact for Inquiries

To get in touch with Sumitomo Mitsui Banking Corporation, dial 81-3-3282-8111. This contact number connects you directly to their main branch in Tokyo, ensuring swift assistance for your inquiries.

Main Branch Address

Located at 1-1-2, Marunouchi, Chiyoda-ku, in the heart of Tokyo, Japan, the main branch of Sumitomo Mitsui Banking Corporation serves as a key site in Tokyo's bustling financial district.

This central location is not only pivotal for local operations but also caters to both local and international clients, reflecting the bank's global scope and dedication to customer service.

Disclaimer

While this article aims to present current and accurate information regarding contact details and location, please be aware that changes to rates and terms may occur without prior notice.

It is advisable to confirm these details directly with official bank sources to make informed decisions related to your financial needs.

Conclusion

Sumitomo Mitsui Classic credit card offers a straightforward online application process, enabling efficient financial management and access to numerous benefits for residents in Japan.

This process allows applicants to apply at their convenience, regardless of time or location. Support is readily available through the bank’s main branch and customer service, ensuring that applicants have the assistance they need.

As financial tools advance, the Sumitomo Mitsui Classic credit card continues to be a dependable choice for personal finance management in Japan.

P-one Credit Card Application: Step-by-Step Guide

The P-One Standard credit card provides benefits designed to meet your financial needs in Japan. This guide details the simple application steps.

Knowing the eligibility criteria and necessary documents can help you apply with confidence. This guide, tailored for applicants in Japan, embraces convenience and rewards.

P-One Credit Card Overview

The P-One Standard Credit Card is tailored for Japanese individuals seeking convenience and rewards. It simplifies the application process and includes several benefits.

Notably, it features competitive interest rates and a user-friendly interface tailored to the Japanese market.

This card addresses various financial needs and has become a favored choice in Japan. With shopping discounts and travel perks, it delivers substantial value. Knowing the features and how to apply is crucial for anyone considering this card.

P-One Credit Card Features and Benefits

The P-One Standard Credit Card in Japan provides a tailored solution for diverse financial needs, ensuring you benefit from every transaction.

Reward Points System

With the P-One Standard Credit Card, you accrue points on purchases. These points can be converted into a variety of rewards, elevating your shopping experience in Japan.

The system is crafted to maximize benefits effortlessly, allowing you to enjoy extensive redemption options.

Cashback Options

With the P-One Standard Credit Card, you can experience a 1% cashback on charges, effectively putting money back in your wallet and making each purchase more satisfying.

This straightforward cashback system ensures you economize on expenses and enhance the value obtained from your expenditures.

Travel Benefits

The P-One Standard Credit Card enriches your travel experiences with perks, including discounts on rental cars and travel bookings, offering up to 8% off.

It’s the perfect travel partner for exploring new horizons, making travel more economical and convenient within and beyond Japan.

Security Features

Security is paramount with the P-One Standard Credit Card, featuring loss and theft protection to secure your financial activities. Comprehensive safety measures allow confident use, knowing your transactions are protected.

Eligibility Criteria and Preparation

To apply for the P-One Standard Credit Card in Japan, specific criteria must be met:

Age Requirements

It would be best if you were at least 18 years old to apply for this credit card, ensuring responsible usage.

Income Requirements

The card comes with particular income requirements to ascertain your capacity to manage credit. Ensure these guidelines are met to bolster your approval odds.

Assessing Your Financial Health

Evaluate your income, expenses, and any existing debts. This evaluation aids not only lenders but also yourself in confirming readiness for credit card responsibility.

Enhancing Your Credit Rating

Your credit score affects eligibility for different credit cards, associated interest rates, and potential rewards.

If your score needs improvement, timely bill payments, debt reduction, and regular credit report reviews can help. Consider secured credit cards as an option, particularly beneficial for building credit in Japan.

Understanding Associated Costs

Be aware of the costs associated with credit cards, such as annual fees, interest rates, and penalties for late payments. Knowing these costs helps avoid unforeseen debts and financial challenges.

Steps on How to Apply Online Correctly

To secure a P-One Standard Credit Card in Japan, navigate directly to the bank’s official website. The process is designed for efficiency—simply follow these steps:

- Access the P-One application portal on the official website.

- Complete the online form, ensuring all details are accurate.

- Submit your application and await confirmation of approval.

Required Documents

For your application, the following documents are necessary to confirm your eligibility:

- Proof of identity, such as a passport or driver’s license.

- Proof of income, including recent pay slips or tax documents.

- Verify the Verify address, which could be a utility bill or lease agreement.

Tips on Applying

Here's how you can enhance your P-one Credit Card application to meet the expectations of lenders in Japan:

- Ensure Accuracy: For your P-one Credit Card application, it's vital to double-check the information you submit. Accuracy ensures a smoother approval process. Every detail counts, from your personal data to financial statistics.

- Maintain a Good Credit Score: In Japan, your credit score is a key factor in the success of your P-one Credit Card application. Maintain a robust credit rating by settling bills promptly and wisely managing your debts.

- Provide Complete Documentation: Submit all necessary documents without delay. For the P-one Credit Card, any missing information could delay or even derail your application.

- Be Honest: Always provide true and complete details about your finances. Honesty builds trust with the lender and is essential for the approval of your P-one Credit Card.

- Follow-Up: Show your keen interest in obtaining the P-one Credit Card by following up with the bank after your application submission. It can speed up the review process.

- Be Patient: The process for P-one Credit Card approval in Japan may be time-consuming. Patience is essential as you wait for the bank's decision.

- Prepare for Verification: Be ready for any additional verification the bank might require for your P-one Credit Card application, such as phone verifications or supplementary documents.

- Understand the Terms: Fully comprehend the terms and conditions associated with the P-one Credit Card. Knowledge of these details aids in making a well-informed decision.

After You Get Your Credit Card

Congratulations on your approval for the P-one Credit Card! Now that you have your card, the next steps are vital for managing your financial health in Japan.

Activating and Using Your P-one Credit Card

Expect your P-one Credit Card to arrive within 10 to 14 business days. If needed, you might speed up the delivery process. Once received, activating your card is your first step.

Activation is straightforward and marks the beginning of your journey with your new credit card. Start using it for purchases, always ensuring that you spend within your budget to maintain financial stability.

Managing Your P-one Credit Card Responsibly

Managing your credit card wisely is key to building a strong credit score in Japan. This includes timely bill payments and maintaining a low balance. Shifting from using cash or a debit card to a credit card requires discipline.

Although spending freely is tempting, it's wise to treat your credit card like a debit card.

Aim to clear your balance each month to avoid high-interest charges. Responsible use of your P-one Credit Card could lead to more favorable terms on loans and interest rates in the future.

Interest Rates and Fees

Understanding the P-One Credit Card's interest rates and fees is essential for effective financial management.

Annual Percentage Rate (APR)

Based on creditworthiness, the P-One Credit Card offers an APR that varies from 5.03% to 17.95%.

This rate is applicable to purchases, cash advances, and balance transfers within Japan. Maintaining timely payments is vital to prevent higher interest charges and to manage repayments efficiently.

Balance Transfer Fees

The P-One Credit Card charges a balance transfer fee ranging from 3% to 5% of the transferred sum.

This feature is useful for consolidating debts and reducing interest costs. However, evaluating the total costs is important to ensure it’s a financially sound decision in Japan.

Late Payment Charges

Late payment fees on the P-One Credit Card can significantly affect your budget. These fees arise if the minimum payment isn’t made by the due date. Setting reminders or enrolling in automatic payments can help avoid these fees and keep your credit score healthy in Japan.

Customer Support for P-one Credit Card

The P-one Credit Card offers reliable customer support, ensuring assistance is readily available for any inquiries or issues that cardholders in Japan might encounter.

Contact Information

Cardholders can reach the customer support team directly at 81-3-5441-3450.

The team is located at Sumitomo Fudosan Onarimon Tower, 1-1-1 Shiba Park, Minato-ku, Tokyo, 105-0014, Japan. This contact is vital for swiftly addressing any issues, such as lost cards or billing concerns.

Note: Please be aware that the details provided may be updated to ensure you always have access to the most current information to manage your financial needs effectively.

Conclusion

Securing a P-One Standard credit card in Japan involves clear steps, presenting several advantages.

To proceed, familiarize yourself with the interest rates, fees, and eligibility requirements. Manage your payments in a timely manner and contact customer support when necessary.

Utilizing the P-One Standard credit card effectively aids in financial management and enhances the enjoyment of its rewards for residents in Japan.

Complete Guide to Applying for the Epos Gold Credit Card

When selecting a credit card in Japan, understanding the Epos Gold Credit Card's application steps and benefits is crucial. This guide offers a straightforward pathway to boost your financial flexibility and access enhanced rewards.

Here, you'll learn about the key benefits of the Epos Gold Card, including loyalty points and travel perks explicitly tailored for discerning users in Japan.

The article provides a detailed outline of the application process, ensuring you have all the necessary information to determine if this card meets your needs.

Epos Gold Credit Card

The Epos Gold Credit Card, issued by Marui, is crafted to enhance both shopping and travel for cardholders in Japan.

This card not only facilitates financial transactions but also offers a range of benefits that cater specifically to the lifestyle preferences of frequent shoppers at Marui stores and online through their Web Channels.

Upon registration, cardholders are rewarded with a bonus, underscoring Marui's dedication to customer satisfaction.

Easy Online Application Process

The convenience of the application process, which is available both in-store and online, ensures it is accessible to a wide audience in Japan, making the Epos Gold Credit Card a compelling choice for consumers seeking additional value from their credit cards.

Simple Explanation of the Card

The Epos Gold Credit Card provides an attractive package with numerous benefits aimed at improving your shopping and travel experiences in Japan.

Benefits of the Epos Gold Credit Card

This card offers a suite of advantages tailored to enrich the lifestyle of its users in Japan, specifically enhancing both shopping and travel activities.

- You receive an initial bonus of 2,000 Epos Points when you start using your card. These points are worth a 2,000 yen discount and can be used at any Marui location.

- You have the choice between a physical or a web coupon, each valued at 2,000 yen, available right after you get your card.

- The perks of the card apply across all Marui platforms, both in physical stores and online, ensuring you can utilize your rewards wherever you prefer.

How Do You Apply for the EPOS Gold Card in Japan?

Applying for the Epos Gold Card in Japan involves a clear and simple process. Here's what you need to do:

Step-By-Step Application Process

- Navigate to the official website of the issuing bank.

- Locate the section dedicated to the Epos Gold Card and initiate the application.

- Complete the application form carefully, ensuring all information is correct.

- Provide all necessary documents for verification.

- After submitting your application, await confirmation. Upon approval, your card will be issued and sent to you.

Required Documents and Information for the Epos Gold Credit Card

When applying for the Epos Gold Card in Japan, one needs to prepare several personal and financial documents.

This set includes valid identification, proof of income, and details about current employment. It's also typical for a credit assessment to occur, where a credit report might be requested to evaluate one's creditworthiness.

Maintaining accurate and updated documents is key to facilitating a seamless application process.

Eligibility for the Epos Gold Credit Card

To be eligible for the Epos Gold Credit Card, applicants in Japan must satisfy certain requirements that align the card with their financial and lifestyle needs:

- The applicant must be of legal age to form a binding contract.

- A stable income is essential to qualify for the card.

- One can apply either directly at Marui stores across Japan or through Marui’s online mail-order service, catering to both traditional and digital application preferences.

Tips for a Smooth Epos Gold Credit Card Application Process in Japan

To enhance your chances of approval for the Epos Gold Credit Card, adhere to these straightforward tips:

- Review Your Application: Carefully examine your application form for any errors before submitting it. Accuracy is key in Japan, where attention to detail is highly valued.

- Prepare Your Documents: Have all required documents current and ready. This includes proof of income and residency, which are crucial in Japan's meticulous application evaluations.

- Optimal Timing: For online applications, consider applying during off-peak hours to circumvent any server delays. This ensures a smoother online experience.

- In-Person Applications: If you choose to apply in person, opt for quieter times at the bank. This strategy can lead to more dedicated assistance from the staff, improving your application experience.

Interest Rates and Fees for the Epos Gold Credit Card in Japan

For the Epos Gold Credit Card, an annual interest rate of 14.6% is charged on all late payments for general card use, effective from the day after the payment due date until the debt is cleared.

This same rate also applies to product purchases if the payment becomes overdue, encouraging cardholders in Japan to pay promptly to avoid additional costs.

Understanding the Fees

Before applying for the Epos Gold Credit Card, it's essential to consider the following fees:

- Annual Fees: Depending on the cardholder's selected plan and the benefits included, an annual fee may be charged.

- Late Payment Charges: Any overdue amounts incur an annual late payment charge of 14.6%, which can significantly increase the total cost if payments are not managed on time.

- Other Fees: The card also includes fees for cash advances and foreign transactions, along with penalties for exceeding the credit limit, each of which should be considered by potential cardholders in Japan.

Managing Your Epos Gold Card

Managing your Epos Gold Card is vital to maximizing its benefits in Japan.

Activation and Setting Up Online Access

Activate your Epos Gold Card upon receipt. Set up online access to monitor transactions, view balances, and make payments easily.

This online platform is essential for tracking spending and managing the account effectively.

Credit Limit and Statement

Your Epos Gold Card has a credit limit based on your financial profile. Reviewing statements helps you stay within this limit and manage finances responsibly. Knowing your spending and ensuring it aligns with your budget is important.

Making Payments and Avoiding Penalties

Timely payments prevent late fees and interest charges. Set up automatic payments or reminders to avoid missing due dates. Understanding penalties for missed payments can help manage the Epos Gold Card more effectively.

How to Reach Out for Inquiries?

For inquiries or assistance related to the Epos Gold Credit Card, contacting the bank directly is the best approach. This guarantees accurate and up-to-date information.

Bank Contact Information

For matters regarding the Epos Gold Credit Card, call 03-3383-0101. Send correspondence to 3-22-14, Minami-cho, Kokubunji-shi, Tokyo 185-0021.

This contact information is useful for sending documents, making inquiries, or resolving issues related to your credit card. Keeping this information handy ensures smooth communication with the bank.

Disclaimer: Terms and conditions of the Epos Gold Credit Card may change. Always check the latest information directly with the bank for the most current details.

Conclusion

The Epos Gold Card offers a range of benefits tailored to different preferences, enhancing financial activities through rewards and advantages in travel and shopping.

Applying for the Epos Gold Card is straightforward. Meeting the eligibility requirements and completing the simple application process are all it takes. For those in Japan seeking a new credit card, the Epos Gold Card stands out with its extensive features and benefits.

How to Apply for the BicCamera Suica Card: A Detailed Guide

The BicCamera Suica Card offers convenience for daily transactions. Here’s a clear, step-by-step guide to the online application process.

Follow this guide to apply for the card and start enjoying its benefits. Frequent shoppers at BicCamera and regular commuters in Japan will find this card simplifies life.

Key Information About the BicCamera Suica Card

The BicCamera Suica Card is a versatile prepaid card for transportation and shopping in Japan. It’s accepted on JR East trains and at participating retail stores.

Recharge Options:

- Mobile Suica

- Automatic Charge

- Ticket Vendors

- BYUARUTTE of JR East

Points System:

- Earn 1.5% points on automatic or mobile Suica recharges.

- Earn 0.5% points on charges at ticket vendors or BYUARUTTE.

Recharge Limit:

- The maximum single recharge limit is 20,000 yen.

This card simplifies travel and shopping, making it convenient for daily use in Japan.

Benefits of the BicCamera Suica Card

Regular users of the BicCamera Suica Card in Japan enjoy several benefits:

- Earn 1.5% points on automatic or mobile Suica charges.

- Receive 0.5% points on charges at JR East ticket vendors or BYUARUTTE.

- BIC points are equivalent to the cash payment percentage at Kojima Sofmap stores.

- Payment with the card is accepted at select stores.

- Points and rates may vary based on products and store locations.

- The card’s upper limit for a single recharge is 20,000 yen.

Eligibility Criteria You Need to Apply

Applicants need to meet certain criteria to apply for the BicCamera Suica Card. These include age, residency status, and credit score.

Age Requirements

Applicants must be at least 18 years old to apply. Minors can apply with parental consent.

This age requirement ensures legal eligibility to enter into a contract. Specific criteria can be checked on the official website.

Age verification is standard during the application. Meeting this requirement is the first step in qualifying for the card.

Residency Status

Applicants must have valid residency status in Japan. This includes Japanese citizens and foreign residents with a valid visa. Proof of residency is required during the application process.

The card is intended for residents who can benefit from its features daily. Ensuring stable residency helps manage the card effectively. Knowing your residency status is necessary before applying.

Credit Score Considerations

A good credit score is important for approval. Applicants with a history of timely payments have a better chance of being approved. Credit score checks are a routine part of the process.

Review your credit report prior to applying. A higher score increases the likelihood of receiving favorable terms. Maintaining a good credit score is essential for financial health and card approval.

Required Documents

Applicants must prepare specific documents to complete the BicCamera Suica Card application process. These include identification proof, address verification, and income proof.

Identification Proof

A valid government-issued ID is necessary for identification. This can include a passport, driver’s license, or My Number Card.

The ID must be current and contain a photograph. This requirement verifies the applicant’s identity. Providing valid proof of identification is a critical step in the application process for the BicCamera Suica Card.

Address Verification

Proof of address is needed to confirm the applicant’s residency in Japan. This can be a utility bill, bank statement, or official government correspondence. The document must show the applicant’s name and current address.

Address verification ensures that the BicCamera Suica Card is sent to the correct location. It is important to have recent and accurate proof of address.

Income Proof

Proof of income is required to assess the applicant’s financial stability. This can include recent pay stubs, tax returns, or bank statements.

The documents should reflect a steady source of income. Income proof helps in evaluating the applicant’s ability to manage credit.

Providing accurate income information is essential for a smooth application process for the BicCamera Suica Card.

Online Application Process for BicCamera Suica Card in Japan

The online application for the BicCamera Suica Card is straightforward and convenient. Follow these steps to complete the process:

Step 1: Visit the Official BicCamera Website

Begin on the official BicCamera website. Locate the Suica Card section on the homepage. This section provides detailed information about the card and its benefits. This step is essential to start your application.

Step 2: Navigate to the Suica Card Application Section

On the website, find the Suica Card application section. This section contains the online application form. Follow the instructions carefully. Navigating correctly ensures a successful application.

Step 3: Fill in the Application Form

Complete the application form with personal and financial details. Ensure all information is accurate and current.

The form requires details such as name, address, income, and employment. Accurate information is vital for a smooth application.

Step 4: Upload Necessary Documents

Upload the required documents: identification proof, address verification, and income proof. Ensure documents are clear and legible. Correct documents are essential for verification.

Step 5: Review and Submit the Application

Review your application and uploaded documents for accuracy. Once satisfied, submit your application. You will receive a confirmation upon successful submission. A thorough review is essential to avoid errors.

Activation and Initial Setup

Start using your BicCamera Suica Card by following these steps:

- Receive the card: After approval, the card will be mailed directly to the registered address in Japan.

- Follow the instructions: Use the guide provided in the package to activate the new card.

- Register online: Visit the official website to complete the necessary registration.

- Set up your PIN: Create a secure PIN for all transactions.

- Link to mobile: For easy management, link the card to the recommended mobile app.

How to Load and Reload the Card

Keeping your BicCamera Suica Card loaded is essential. Here’s how to do it:

- Automatic charge: Set up automatic charges through the app.

- Mobile Suica: Use the mobile app for quick recharges.

- Ticket vendors: Visit JR East ticket vendors for reloading.

- BYUARUTTE: Utilize JR East’s BYUARUTTE machines for additional reloading options.

- Cash reload: In-store cash reloads are also available.

Where and How to Use the BicCamera Suica Card for Purchases and Transit in Japan

The BicCamera Suica Card is versatile for shopping and transit. Use it on JR East trains by tapping at the gates. For purchases, present the card at checkout in participating stores in Japan.

Ensure the balance is sufficient for transactions. The card is widely accepted in many retail outlets and convenience stores across Japan.

Check the balance regularly to avoid any issues. In Japan, the BicCamera Suica Card offers seamless travel and shopping experiences.

Fees and Interest Rates for the BicCamera Suica Card

Knowing the fees and interest rates is key to managing your BicCamera Suica Card effectively. Here's what you need to know.

Detailed List of Applicable Fees

The first year's annual fee is free. After the first year, an annual fee is charged. There are no transaction fees for in-store purchases in Japan.

However, certain services, like cash advances, may incur fees. International use may lead to foreign transaction fees. Always check your statement for detailed fee information.

Interest Rates for Purchases and Cash Advances

Interest rates apply to both purchases and cash advances. The purchase rate is a standard annual percentage rate (APR).

Cash advances have a higher APR compared to purchases. Interest starts accruing from the transaction date for cash advances.

Paying off the balance monthly can help avoid interest charges. Keep track of due dates to manage interest effectively.

BicCamera Suica Card Bank Details

For any questions or assistance regarding the BicCamera Suica Card, contact the bank directly.

Address and Contact Number

The bank is located at 3-23-23 Takada, Tokyo, Tokyo, Japan. For inquiries, call +81 339878785. Customer service is available during regular business hours. Reach out for support or information.

Disclaimer: Using the BicCamera Suica Card involves legal considerations and limitations. Always read the terms and conditions carefully to understand responsibilities.

Conclusion

This guide details how to apply for and use the BicCamera Suica Card. Following the outlined steps simplifies the application process.

Knowing the card’s features, fees, and interest rates ensures optimal use. Keep the bank’s contact information for support. Enjoy the convenience and benefits of using the BicCamera Suica Card in Japan.

Devlet Yakacak Yardımı (Odun Kömür Desteği)

Aile, Çalışma ve Sosyal Hizmetler Bakanlığı tarafından yardıma muhtaç ailelere aynı ve nakdi yardımlar yapılmaya devam etmektedir. Kömür yardımı da bunlardan bir tanesidir. Yardım alabilmek için bazı şartlara sahip olmanız gerekiyor. Sigortalı olarak çalışanlara kömür yardımı verilmeyecektir. T.C. kimlik numaranız ile başvuru sonrası sorgulamada da bulunabilirsiniz. Ayrıca yardımlar il ve ilçe merkezlerinde valilikler ve kaymakamlıklara bağlı faaliyet gösteren Sosyal Yardımlaşma ve Dayanışma Vakıfları tarafından yapılmaktadır. Başvurular ile ilgili tüm detayları ve yakacak yardımı alabileceğiniz kurumları içeriğimizde bulabilirsiniz.

Odun Kömür Yardımı Yapan Kurum ve Kuruluşlar

Kış aylarına girdiğimiz şu günlerde yakacak odun ve kömürü olmayan vatandaşlarımızın Devlet Odun Kömür desteği veriyor mu? diye araştırma yaptığını ve bu konuda nereye başvuru yapacağı hakkında bilgilendirme amacı ile yaptığımız araştırmaları sizler ile paylaşmak istiyorum.

Geliri olmayan, hasta, yaşlı ve bakıma muhtaç olan insanlarımıza Odun kömür yardımı yapan kurum ve kuruluşlar hangileridir? Devletimiz belirli kurumlar tarafından kış aylarında odun veya kömür olarak yakacak yardımı adı altında belirli yardımlar yapmaktadır. Bunun yanında farklı maddi ve giyim yardımları da yapılmaktadır. Fakat biz bugün sadece odun ve kömür yardımları hakkında bilgi vermeye çalışacağız. Sizinde etrafınızda bu tarz yardımlara muhtaç olan birileri var ise bunların bu yardımlardan haberdar olmalarında yardımcı olabilirsiniz. Yardımlar konusunda insanlara ilk olarak yardımcı olacak kişiler bulundukları bölgedeki muhtarlar olacaktır. Muhtarlar devlet kurumlarına fakir ve muhtaçların listesini verirken yardımcı olmaktadırlar. İhtiyacı olan vatandaşların devlet kurumlarına başvuru yapmadan önce fakirlik belgelerini bağlı oldukları muhtarlıktan almaları gerekmektedir. Ayrıca muhtaç ailelere sadece devlet kurumları değil sivil toplum kuruluşları ve belediyeler tarafından da yardım sağlanmaktadır. Bu konuda insanlara yardımcı olacak olan Aile, Çalışma ve Sosyal Hizmetler Bakanlığına bağlı Sosyal Yardımlar Genel Müdürlüğüdür. Sizde bu tarz başvurularınızı bu müdürlüğe yapmalısınız. Sosyal yardımlar genel müdürlüğü ihtiyaç sahiplerine yakacak yardımının yanında belirli zamanlarda verilmek üzere giyim ve gıda yardımı da yapmaktadır. Bunların hepsine bir kerede başvuru yapılması mümkündür.

Sosyal Yardımlar Genel Müdürlüğü Yakacak Yardımı

2003 yılından itibaren verilmekte olan bu yardımlar sayesinde ihtiyaç sahibi aileler kış aylarında yakacak sıkıntısı çekmemektedir. Türkiye Kömür işletmelerinden sağlanan kömür Sosyal Yardımlar Genel Müdürlüğü tarafından ihtiyaç sahibi ailelere en az 500 kg olmak üzere dağıtılmaktadır. Devlet bu imkanı verirken aynı zamanda atıl durumdaki yeraltı işletmelerinin ayakta kalmalarına destek olmaktadır. Bunun yanında oturulamayacak derece eski ve bakımsız evlerde yaşamak zorunda olan vatandaşların evlerinin yenilenmesi ve bakımının yapılması için nakdi ve ayni yardımlarda bulunmaktadır. Sizin veya çevrenizde yaşayan ve yakacak yardımına ihtiyacı olanların başvurularını bulunduğunuz bölgedeki sosyal yardımlar müdürlüğüne yapmanız gerekmektedir.

Maddi yardım yapan iş adamları ve zenginler tarafından 2020 yılında verilecek olan desteklere de başvuru yapabilirsiniz.

Belediyelerin Yakacak Yardımları

Ülkemizdeki bütün belediyeler kendi sınırları içerisinde yaşayan ve ihtiyaç sahibi insanlara her kış yakacakları kömür veya odun yardımında bulunarak kış aylarında ısınmalarına yardımcı olmaktadırlar. Sabit bir miktar kısıtlamasının olmadığı belediye yakacak yardımlarında en az 1 ton olarak kömür dağıtılmaktadır. Bu miktar belediyenin ayırmış oldukları bütçe ile değişiklik gösterebilmektedir. Bu imkandan yararlanmak isteyen ihtiyaç sahiplerinin ikametgah belgesi, nüfus cüzdanı ve başvuru formu ile bulundukları belediyelere başvuru yapmaları gerekmektedir. Yapılan başvuruların doğruluğu belediye zabıta ekiplerince yerinde tespit sistemi ile araştırılmakta ve aynı zamanda mahalle muhtarlarından bilgi alınmaktadır. Bilgilerin doğruluğu üzerine dilekçe tarihinden itibaren en geç 1 ay içerisinde belediye ekipleri tarafından muhtaç ailelere kömür yardımı yapılmaktadır.

Sivil Toplum Kuruluşları;

Bu yardımlar Ülkemizin her yerinde aynı zaman ve miktarda yapılmamaktadır. Sivil toplum kuruluşları kendilerinin belirledikleri bölge ve miktardaki yakacakları ihtiyaç sahiplerini ulaştırmaktadırlar. Bu kuruluşların vereceği kömür Belediyeler ve Sosyal Yardımlar Müdürlüğünün gibi süreklilik arz etmemek ile beraber azda olsa ihtiyaç sahipleri tarafından talep edilmektedir. STK ların irtibat büroları veya internet üzerindeki başvuru sayfalarından talep edilebilen yakacak yardımları sayesinde bir çok aile kış aylarında ısınma ihtiyaçlarını karşılamaktadır.

Başvuracağını makamlar;

- Belediyelere,

- Sosyal Yardımlaşma Vakfına,

- Sivil Toplum Kuruluşlarına

- Valilik veya Kaymakamlık Makamına,

- Aile ve Sosyal Politikalar Müdürlüklerine

Başvurunuzu gerçekleştirin. Mutlaka size uzanan bir el olacaktır. Konu hakkında yorum yapın, yanıtlayalım. İstanbul Büyükşehir Belediyesi yardım kartı sayesinde de vatandaşlarımıza destekler verilmektedir.

Devlet tarafından maddi yardım alan ailelere yönelik olarak elektrik faturası desteği verilmektedir. Bağlantıdan şartlar hakkında bilgi alabilir ve verilen elektrik desteğinden yararlanabilirsiniz.